Your Trusted Insurance Agency in Denver, CO

AIS: Your trusted insurance agency in Denver, CO

At Advantage Insurance Solutions, we pride ourselves on being more than just another insurance agency. Nestled in the heart of Denver, Colorado, home to the best insurance agency in Denver, CO, we’ve been serving individuals, families, and businesses across the nation since our establishment in 2005. Our mission is simple yet profound: to provide unparalleled protection tailored to your unique needs. With a dedicated team of experts and an unwavering commitment to excellence, we’ve earned our stripes as a leader in the insurance industry.

Navigating the Denver Landscape:

Nestled against the backdrop of the Rocky Mountains, Denver boasts a vibrant and dynamic community. From the bustling streets of downtown to the serene landscapes of the nearby parks, Denver offers a unique blend of urban living and outdoor adventure. However, with this unique landscape comes its own challenges and risks, making comprehensive insurance coverage essential for residents and businesses alike.

Why Choose Advantage Insurance Solutions?

When it comes to safeguarding what matters most to you, choosing your insurance provider is critical.

Here’s why Advantage Insurance Solutions stands out as your premier choice in Denver, CO:

Independence and Choice

As an independent insurance agency, we have the freedom to handpick the best carriers for your specific insurance requirements. We’re not beholden to any single provider, ensuring you receive tailored coverage that fits like a glove.

Expertise and Dedication

When you partner with us, you’re not just a policyholder but part of our extended family. Our team comprises real people who are highly knowledgeable and deeply dedicated to ensuring you have the coverage you need when you need it.

Community-Centric Approach

“Our Team is Your Advantage” isn’t just a tagline – it’s a philosophy we live and breathe every day. By offering comprehensive protection for your Auto, Home, and Business needs, we empower you to focus on what truly matters while we handle the rest.

Recognition and Reputation

Our client-centric approach and unwavering commitment to excellence haven’t gone unnoticed. We’ve garnered recognition from satisfied customers, esteemed insurance partners, and the communities we proudly serve.

For business owners in Denver, CO, navigating the complex commercial insurance landscape can be daunting. That’s where Advantage Insurance Solutions steps in, offering extensive coverage and personalized solutions tailored to fit your unique needs. Here’s how we can help protect your business:

Comprehensive Coverage: From property and liability protection to safeguarding against business interruption and lawsuits, our business insurance policies provide a robust shield against unforeseen risks.

Risk Mitigation: We understand that every business is unique, so we take a personalized approach to identifying and mitigating your specific risks. Whether you operate a small startup or a thriving enterprise, we’ve got you covered.

Workers’ Compensation: Protecting your employees is paramount. Our Workers’ Compensation insurance ensures that your team is cared for in the event of workplace injuries or illnesses, allowing you to focus on what you do best – running your business.

What Our Clients Say

Hear what our satisfied clients have to say about their experience with Advantage Insurance Solutions

Great Company!! Easy to work with and efficient. I highly recommend working with Advantage!!

– Mark Krajewski –

AIS helps me, adult! I’ve been with Advantage Insurance Solutions for years and have always had a relationship with them. Tristen is smart and honest, she takes time to explain things in detail that I don’t understand. Even though everything is expensive with inflation, they still found a way to save me money and keep full coverage and I added renters insurance this year. Thanks!

– Stephanie Reynolds –

Lori is amazing!! She’s been extremely helpful and saved us over $1000 a year on all our insurance needs. She is quick to answer questions and just all-around great to work with.

Thanks, Lori and staff.

– J Fehr –

I have used Advantage Insurance Solutions for years and appreciate that my insurance needs are always taken care of in a professional and friendly way.

– Nick Potter –

Advantage Insurance Solutions cut my monthly insurance bill by more than 50% with the same coverage! give them a try!

– Anthony Hoehler –

Advantage Insurance has helped me with many of my insurance needs. They are efficient and very professional. I’ve had policies with this company for the past 15 years at least. And I would recommend them to anyone with their insurance needs.

– Wanda –

Tailored Solutions for Every Business from Insurance Agency Denver CO

As your trusted insurance agency in Denver CO, we believe that onesize does not fit all when it comes to insurance. That’s why we offer a wide range of commercial insurance policies designed to meet the diverse needs of businesses across various industries. Whether you need Business Liability Insurance, Commercial Auto Insurance, or specialized coverage for industries like Dental Practices or Food Trucks, we’ve got you covered

What to Consider When Getting a Home Warranty? Mortgage and Home Insurance: An Ultimate Buyers Guide

Owning a house has a rather long “to-do list” in order to enable it to run smoothly. A home warranty, mortgage, and home insurance are essentials in keeping your home habitable. Getting these three takes a lot of consideration and time to decide. Here is some...

25 Insurance Hacks: A Cheat Sheet for Homeowners

Owning a house takes a lot of responsibility and paying all the bills takes a lot of hard work. Hence, thinking for a way to lower our expenses is a must. And knowing some ways to prevent financial risk can help a lot. Here are some hacks that can help you:...

Do I Really Need to Carry Renters Insurance?

Do I need renters insurance? The simple answer is yes! Is it mandatory? No, It’s not. Though having a renters insurance is not required by law, still many landlords require their renters to purchase insurance for safety purposes. This insurance...

Discounts for Home Insurance

Looking for home insurance discounts in Denver? Before getting insurance, you seek more adjustments or great deals to give you coverage and save more, right? Of course, since you are about to face the cost of having insurance, you might as well grab the...

How Can I Make My Auto Insurance Less Expensive

How can you make your car insurance less expensive? Imagine driving a two-month-old car from work one evening. You slow down at an intersection, lightly tapping on the steering wheel while listening to your favorite music from your car stereo. That happens when...

Key Questions to Ask an Agent Before Buying a Farm Insurance Policy

Whether you have a small family farm or a large commercial operation, you need a farm insurance policy. Things can change quickly and you need to know your family, future, and livelihood are adequately protected. It can seem overwhelming to know just what...

RV Insurance 101: Other Types of Insurance Coverage

5 Types of Vehicle Insurance Maintaining an RV is more than a lifestyle. It is a responsibility. The same goes for other insurance policies; RV insurance coverage depends on the risk factor. You don't want to wait for an RV insurance claim to know details about it....

How To Find High-Value Insurance in Denver, CO?

High-Value Insurance, Luxury Homes in Denver, Colorado for AIG Homeowners Insurance Your home is most likely one of your most valuable assets. You will do everything to keep it clean and safe. Suppose you have an expensive and luxurious home. You also need to be with...

RV Insurance 101: Types of RV Insurance Coverage

What different types of RV insurance coverages are there, and what do I need to make sure my recreational vehicles is insured?

Dental Business 101: A Guide to Protecting Your Dental Practice

As of 2020, the market size of the United States Dentists industry is $139.8 billion. In recent years, the industry has experienced faster growth than the economy in general, thanks to low revenue volatility, among other positive factors. While this is...

RV Insurance 101: Basic RV Insurance Coverage

RV Life Recreational vehicles or RVs come with many types and classes. They can be your permanent or temporary home on wheels. If you happen to own one, you probably know that since they have more expensive equipment, they carry bigger risks. That is why there...

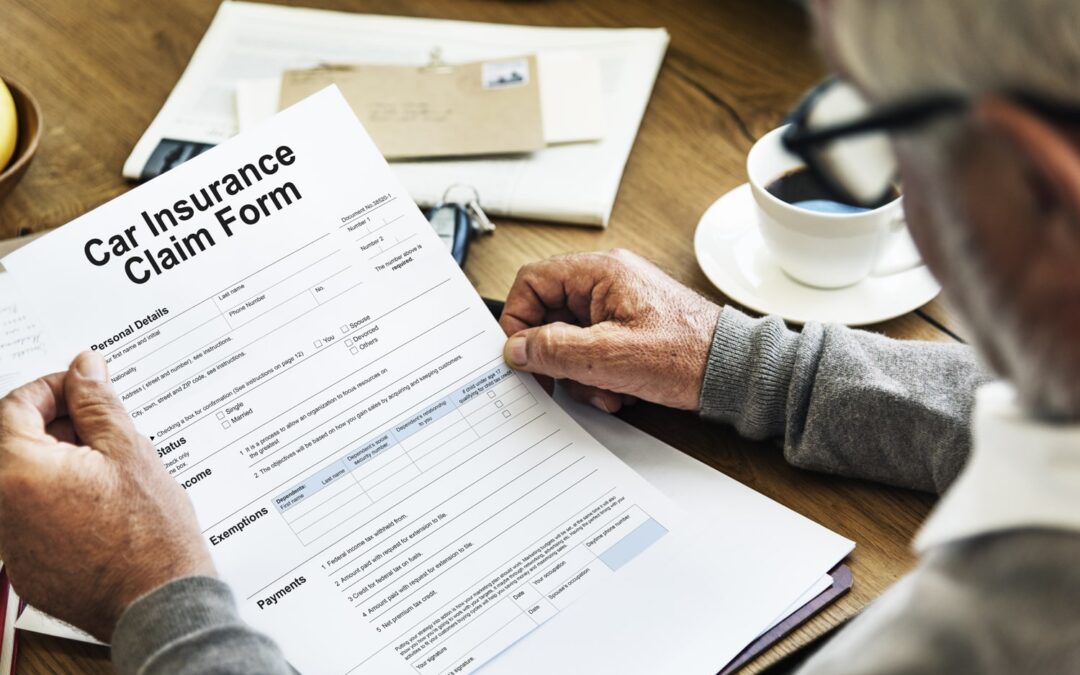

What Should I Do in the Event of a Car Accident?

What to do in the event of a car accident? Accidents are our worst fears. It may strike prepared and unprepared people. Regardless of wrongdoing. Although we cannot predict who will have a car accident, its economic and psychological effects may be mitigated....

The No.1, Most Overlooked Coverage that Every Dental Professional Should Have— Work Comp with Needle

Working as a dental professional has its perks and rewards just like any other health profession. People come to you for proper oral health. You can be an “artist” at the same time because the job is also an aesthetically-focused practice by taking good care of your...

What is a PEO and How Does it Work? The Pros and Cons Explained

Proper Human resource management is very important in any business, be it big or small. From hiring to payroll, every company has a lot to gain from professional employee management. If you do not have the right skills, you might consider hiring a Professional...

How Much is Pet Insurance Do I Need?

Pet insurance: all the rage among pet owners who can afford it. The thing is that there are so many different plans out there. So you may be asking yourself, “how much pet insurance do I need?” In today’s blog, we discuss the factors that can affect the cost of a...

Lowering the Experience Modifier

What is an experience modifier? An experience modifier (EMR/Xmod) is a multiplier or a factor applied to the premium of an eligible policy. This provides an incentive for loss prevention. Workers' Compensation rating bureaus like the National Council on Compensation...

What Discount Should I Look For When Buying Auto and Homeowners Insurance?

What discount should we look for when buying auto and homeowners insurance? Having a house and a car to pay for needs a huge amount of money. And aside from paying for the mortgage, there are also fees for maintenance and of course insurance. Homeowners...

Homeowners Insurance Traps You Don’t Want To Fall Into

For many Americans, owning a home is an essential part of the American dream and one of the most important investments you can make. As your family grows, your needs for insurance will change as well as your risk. Reviewing your insurance program every year to make...

What Age Is Best For Getting Life Insurance?

Imagine this: you're young, fit, and healthy. You're busy building your career and your personal life. You don't need life insurance. Well, that may be how you feel now, but things can change quickly. This blog looks into what age is best for getting life insurance....

When Accidents Happen Part Two: If You Get Injured at Someone Else’s Property

Have you ever thought about what you would do if you get injured at someone else’s property? Nobody ever wishes for accidents to happen, and nobody enjoys wondering about what they would do if or when an accident does happen. However, it is for this very reason that...

Do I Need to Insure My Rental Property Differently?

When you are already insured with a Homeowners Insurance, it will be totally understandable if this question will pop into your mind. Because why do you need to have separate insurance to your rental place? What’s the difference? Landlord Insurance or Rental...

Coverage For Pet Dental Insurance And Other Diseases

You know that owning a pet means so much more than just having one more mouth to feed. You know that having a pet means having one more family member to love. One more family member to take care of and one more family member who definitely loves you back...

Starting A Restaurant Business in 2023

Restaurateurship 101: Start Your Own Business in 2022 Starting your own restaurant is easy. No, just kidding. It would take a lot of time and a lot of planning before you could even really get to Step 1, but it’s not impossible. Through this narrative, we will be...

Business Dental Insurance

Opening a Dental Clinic Opening a clinic to get into the dental practice comes along with the task of getting sued. Risks cannot be avoided completely, but you still have some options to limit or control them to your advantage. Someone who has just started with his...