Your Trusted Insurance Agency in Denver, CO

AIS: Your trusted insurance agency in Denver, CO

At Advantage Insurance Solutions, we pride ourselves on being more than just another insurance agency. Nestled in the heart of Denver, Colorado, home to the best insurance agency in Denver, CO, we’ve been serving individuals, families, and businesses across the nation since our establishment in 2005. Our mission is simple yet profound: to provide unparalleled protection tailored to your unique needs. With a dedicated team of experts and an unwavering commitment to excellence, we’ve earned our stripes as a leader in the insurance industry.

Navigating the Denver Landscape:

Nestled against the backdrop of the Rocky Mountains, Denver boasts a vibrant and dynamic community. From the bustling streets of downtown to the serene landscapes of the nearby parks, Denver offers a unique blend of urban living and outdoor adventure. However, with this unique landscape comes its own challenges and risks, making comprehensive insurance coverage essential for residents and businesses alike.

Why Choose Advantage Insurance Solutions?

When it comes to safeguarding what matters most to you, choosing your insurance provider is critical.

Here’s why Advantage Insurance Solutions stands out as your premier choice in Denver, CO:

Independence and Choice

As an independent insurance agency, we have the freedom to handpick the best carriers for your specific insurance requirements. We’re not beholden to any single provider, ensuring you receive tailored coverage that fits like a glove.

Expertise and Dedication

When you partner with us, you’re not just a policyholder but part of our extended family. Our team comprises real people who are highly knowledgeable and deeply dedicated to ensuring you have the coverage you need when you need it.

Community-Centric Approach

“Our Team is Your Advantage” isn’t just a tagline – it’s a philosophy we live and breathe every day. By offering comprehensive protection for your Auto, Home, and Business needs, we empower you to focus on what truly matters while we handle the rest.

Recognition and Reputation

Our client-centric approach and unwavering commitment to excellence haven’t gone unnoticed. We’ve garnered recognition from satisfied customers, esteemed insurance partners, and the communities we proudly serve.

For business owners in Denver, CO, navigating the complex commercial insurance landscape can be daunting. That’s where Advantage Insurance Solutions steps in, offering extensive coverage and personalized solutions tailored to fit your unique needs. Here’s how we can help protect your business:

Comprehensive Coverage: From property and liability protection to safeguarding against business interruption and lawsuits, our business insurance policies provide a robust shield against unforeseen risks.

Risk Mitigation: We understand that every business is unique, so we take a personalized approach to identifying and mitigating your specific risks. Whether you operate a small startup or a thriving enterprise, we’ve got you covered.

Workers’ Compensation: Protecting your employees is paramount. Our Workers’ Compensation insurance ensures that your team is cared for in the event of workplace injuries or illnesses, allowing you to focus on what you do best – running your business.

What Our Clients Say

Hear what our satisfied clients have to say about their experience with Advantage Insurance Solutions

Great Company!! Easy to work with and efficient. I highly recommend working with Advantage!!

– Mark Krajewski –

AIS helps me, adult! I’ve been with Advantage Insurance Solutions for years and have always had a relationship with them. Tristen is smart and honest, she takes time to explain things in detail that I don’t understand. Even though everything is expensive with inflation, they still found a way to save me money and keep full coverage and I added renters insurance this year. Thanks!

– Stephanie Reynolds –

Lori is amazing!! She’s been extremely helpful and saved us over $1000 a year on all our insurance needs. She is quick to answer questions and just all-around great to work with.

Thanks, Lori and staff.

– J Fehr –

I have used Advantage Insurance Solutions for years and appreciate that my insurance needs are always taken care of in a professional and friendly way.

– Nick Potter –

Advantage Insurance Solutions cut my monthly insurance bill by more than 50% with the same coverage! give them a try!

– Anthony Hoehler –

Advantage Insurance has helped me with many of my insurance needs. They are efficient and very professional. I’ve had policies with this company for the past 15 years at least. And I would recommend them to anyone with their insurance needs.

– Wanda –

Tailored Solutions for Every Business from Insurance Agency Denver CO

As your trusted insurance agency in Denver CO, we believe that onesize does not fit all when it comes to insurance. That’s why we offer a wide range of commercial insurance policies designed to meet the diverse needs of businesses across various industries. Whether you need Business Liability Insurance, Commercial Auto Insurance, or specialized coverage for industries like Dental Practices or Food Trucks, we’ve got you covered

The Rise of Work-from-Anywhere: A Future Outlook for Business Owners

In recent years, a transformative shift has been reshaping the landscape of work culture - the rise of work-from-anywhere. Driven by advancements in technology and changing employee preferences, this flexible work arrangement has gained momentum, particularly in the...

Enhancing Your Insurance Coverage: Hidden Factors You Might Be Overlooking

Insurance coverage plays a crucial role in protecting individuals and businesses from unforeseen risks. While many people recognize the importance of having insurance, they often overlook hidden factors that can significantly impact their coverage. In this blog, we...

The Defensive Driving Process

Driving is, without a doubt, an essential part of our ability to be self-sufficient. Good driving skills are required for safe travel. However, learning to drive is a difficult task, and we may encounter numerous problems while driving on roads. People must be aware...

Shopping for Auto Rates

If you don't have the cash to buy a car, it may seem impossible, but an auto loan can help you get reliable transportation. An auto loan is secured by a car and allows you to pay in fixed monthly instalments rather than all at once. By charging you less...

What Is Garage Liability Insurance?

Automobile dealerships, parking lot or parking garage operators, tow-truck operators, service stations, and customization and repair shops will add garage liability insurance to their business liability coverage. The policy covers property damage and bodily injury...

HOMEOWNERS: Safeguarding Your Home with Adequate Coverage

INSURANCE TO VALUE Choosing the right amount of coverage for your home is a critical decision regarding your homeowner's policy. Your home is more than just a place to live; it's your most valuable asset. You may need proper coverage to rebuild after a total loss....

Insurance for Domestic Help: Protecting Your Liabilities

How can you protect your liabilities with insurance for domestic help? When hiring help in your home, it's important to consider increasing your insurance coverage to safeguard against potential liabilities. This may include obtaining additional liability coverage,...

Benefits of Bundling Insurance Policies

Apply For ERC Now! All your insurance policies are designed to protect you financially, but did you know that keeping your coverage with the same provider can provide you with an additional bundled discount? Benefits of Bundling Insurance Policies Most personal...

Insuring Your College Student: Important Considerations

Contact Us To Apply For ERC! When your child prepares to leave for college, reviewing your insurance coverage is crucial to ensure adequate protection during this new phase of their life. Understanding how your coverage may change and taking proactive steps can help...

Are You Prepared? Protecting Your Home from Wildfires

Homeowners often face the risk of wildfires, which can be triggered by lightning strikes or accidents, spreading rapidly and engulfing brush, trees, and homes. It is crucial to make adequate preparations to minimize risk and protect your family and property during...

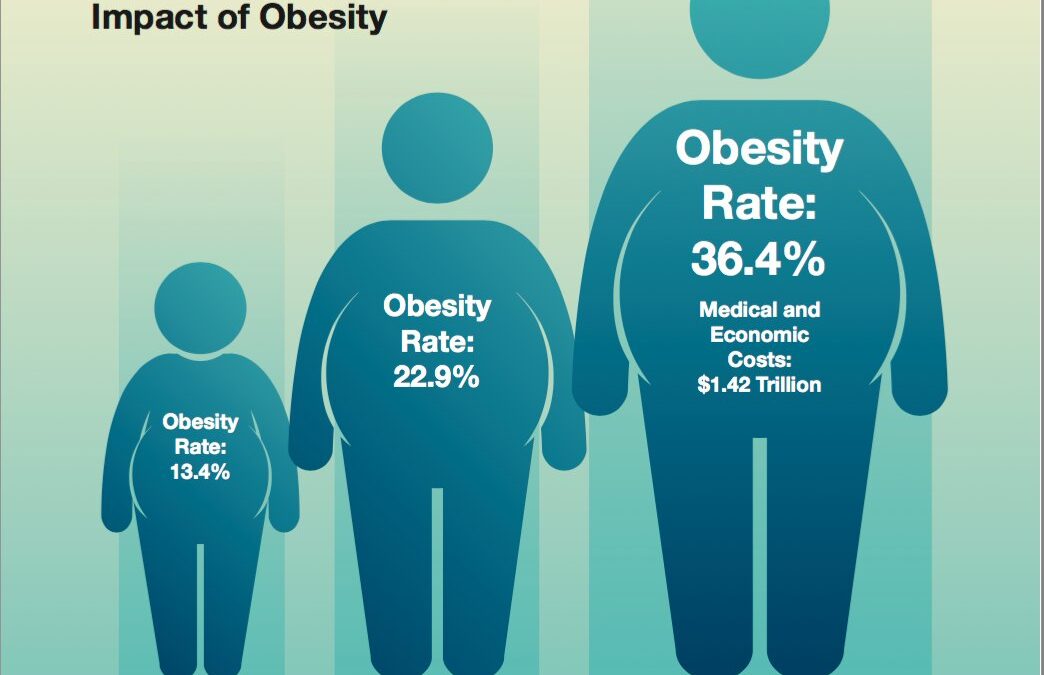

The Impact of AMA’s New Classification on Obesity: How It Affects Your Bottom Line

Obesity has long been recognized as a significant health concern, affecting individuals and communities worldwide. Recently, the American Medical Association (AMA) made a significant update to its classification of obesity, shedding new light on the severity and...

Understanding Claim Reserves: A Key Aspect of Workers’ Compensation

Insurers must establish claim reserves when managing workers' compensation claims within an organization. These reserves serve as designated funds to cover the anticipated costs of such claims. It is essential for insurers and organizations alike to accurately...

Frequency of Vehicle Thefts

According to the Hot Wheels Report and the 2021 Hot Spots Report from the National Insurance Crime Bureau (NICB). In the United States, Bakersfield, California, has the greatest rate of auto theft, according to the National Insurance Crime Bureau's 2021 Hot Spots...

Understanding Cumulative Trauma Injuries and Their Prevention

Cumulative trauma injuries pose significant organizational challenges, often resulting in complex and costly workers' compensation claims. Unlike acute injuries, cumulative trauma injuries develop gradually over time due to repetitive movements, making them more...

Building Effective Relationships with Medical Providers in Workers’ Compensation

Building Effective Relationships with Medical Providers in Workers' Compensation When dealing with a workers' compensation claim in your organization, it is essential to provide strong support for the recovery of the affected employee. Establishing a solid...

Commercial Auto Sees Best Results in a Decade, but Future Profits Remain Uncertain

The Governing Body of the ILO decided to hold a technical discussion on the future of work in the automotive sector and the need to invest in people's capacities as well as decent and sustainable work during its 335th Session. In the light of ILO's Centennial...

10 Facts About Distracted Driving

About Distracted Driving Did you know about 3,000 people die from distracted driving in a year? If you are aware of what distracted driving is, you may be mindful of what distracted driving is. Everyone should understand what distracted driving is and what causes it...

Protecting Commercial Property Against Hail

Hail can be a significant weather worry everywhere in the world. Mass deviation can be caused by ice pellets that are as small as a pea or as large as a golf ball. Strong winds and hail can cause extensive damage that could cost thousands of dollars to fix. This...

Driving in Extreme Weather

All drivers encounter adverse weather conditions at some point. Unfortunately, many people underestimate the modifications to driving style that are necessary. According to statistics and research conducted in the US, 24% of all crashes take place in inclement...

Understanding the Care, Custody or Control Exclusion

American drivers see a lot on their travels, travelling more than 13,000 miles a year on average. It's also one of the last locations you want to run into furry pals when you're moving at 40, 50, or even 60 mph or more. We rarely take the time to evaluate the scope of...

The Essential Insurance Coverage for Liquor Store Owners in the USA: Protecting Your Business and Customers

As a liquor store owner in the USA, it's essential to have the right insurance coverage to protect your business from potential risks and liabilities. Liquor stores face unique risks and challenges that require specialized insurance coverage to ensure that your...

Beware of Animals on the Road

American drivers travel more than 13,000 miles per year on average, so they see a lot on their trips. It's also one of the last locations you want to run into animal pals when travelling at speeds of 40, 50, or even 60 or more mph. Although it poses a severe safety...

Strategies for Managing Insurance Costs and Maintaining Adequate Coverage for Your Liquor Store

Owning a liquor store can be a lucrative business, but it also comes with its own set of risks and challenges. One of the most significant risks is the possibility of liquor liability claims, which can be costly and damaging to your business's reputation. Therefore,...

The Importance of Liquor Liability Insurance for Liquor Store Owners: Protecting Your Business and Your Customers

Liquor stores are an essential part of the community, providing customers with a wide range of alcoholic beverages. However, with the sale of alcohol comes the responsibility of ensuring that customers do not cause harm to themselves or others while under the...