What is Cyber Liability Insurance?

Cybersecurity is a significant issue affecting businesses of all sizes and in the modern world where Companies majorly rely on technology, these threats are so real. That is why at Advantage Insurance Solutions, we truly appreciate the fact that the protection against these risks is a matter of primary concern for any company. In this policy we cover Cyber Liability which offers substantial protection against data breach and other forms of cyber related crimes, thereby giving your business the necessary strength and ability to withstand such risks.

Cyber liability insurance is not just about having a piece of paper with some impressively written words on it, it’s about having a tool to help protect your business. It provides a combination to coverage that suits an organization to protect against the financial and brand damage of cyber threats. Cybersecurity is one of the most important sections to address when engaging in digital business because it is not a matter of if you will get hit by a cyber threat, but when. Cyber Liability Insurance is an essential protective measure your business needs to incorporate as soon as today.

Real-World Impact of Cyber Threats

An example is the Rokenbok toy firm that is confronted with a real-life cyber attack in the middle of the rush for the holiday seasons. Computer hackers demanded money from the company as they had kidnapped its files through an act of cyber theft which involved encrypting all its information. This breach resulted to significant losses made when executing the orders. Worse still, this was not the first time the company had experienced an attack or a hack, a cyber incident. Earlier in the year, for instance, they were Locked out of their site by an attack known as Denial of Service.

Paul Eichen, CEO of Rokenbok, described the harrowing experience in an interview with the New York Times: This was one that made me work it out. ” To the customers, initial perceptions are very important and it took the company four days to rebuild its data base while the hackers were never apprehended.

Rokenbok’s experience is typical for any organization that relies on computers and electronic data meaning business results, taxes, invoices, or any other information that needs protection. 90% of companies that lose data for more than a week are doomed to failure since the process of recovering these losses is very expensive. Also, if your system holds firm data relative to the clients, employees, or vendors, it may cause lawsuits and high costs in case of the data leakage.

The Necessity of Cyber Insurance

Let’s take a look at why every business – whether small, medium, or large – should consider getting Cyber Liability Insurance. This coverage will pay for the costs incurred in cases of data breaches and the likes under cyber risks. Accompanying laws that virtual states impose towards businesses to inform the affected people of data breaches make it even more imperative to need a cyber liability policy.

More specifically, at Advantage Insurance Solutions, we have a policy known as cyber liability, meant to protect companies from the financial risks emerging from data theft and other cyber related calamities. We have several options which are included in the policies such as the first and third party options among which some are standard while you can opt for the others depending on your requirements.

First-Party and Third-Party Coverages

First-party losses include all the costs that your business faces in the direct wake of a breach. This includes expenses connected with the notification of customers that there was an attempt at hacking the company’s network. Third-party liabilities cover those claims which may be filed against your business by any other party that was impacted by your cyber event, like a client suing you for negligence, given that the criminals involved in cyber examines stole his/her data that you stored in your system.

Comprehensive Protection with Cyber Insurance

With a well-rounded cyber liability policy from Advantage Insurance Solutions, you can feel confident in your coverage against data breaches and related issues. Here’s what our comprehensive policy includes:

- Data Compromise Protection: Covers employee and customer information if your data is hacked, stolen, corrupted, or compromised due to internal fraud.

- Legal Cost Protection: Covers costs incurred from legal reviews.

- Forensic Services: Helps determine the nature, extent, and perpetrators of a breach.

- Personal Services: Provides helpline services, credit monitoring, and case managers for identity theft victims.

- Public Relations Costs: Pays for firms to manage the potential impact of a data compromise on your company’s reputation.

- Legal Defense Costs: Covers expenses if your company is sued due to a breach.

- Identity Recovery Protection: Assists in restoring the credit history and records of identity fraud victims, including owners, employees, and family members.

Who Needs Cyber Insurance?

Any business, firm or organization that has embraced technology in their operations faces the risk of cybercrimes. Essential for any business, Cyber Liability Insurance is a vital for both international companies and small businesses located in the territory of your country. Currently, as we realize improvements in the different aspects of the technology world, it is to be expected that the varieties of threats to the cyberspace will also increase in the future. Hence, it is essential for businesses to have sufficient coverage in cyber liability insurance as well as develop sound cybersecurity measures to counter these risks.

Why Choose Advantage Insurance Solutions?

At Advantage Insurance Solutions, we go beyond offering generic insurance products. We understand that each business has unique needs and risks. Here’s why partnering with us is the best choice for your cyber liability insurance needs:

- Tailored Coverage: We don’t believe in one-size-fits-all policies. Our team works closely with you to understand your business and structure a policy that provides the specific protection you need.

- Local Expertise: As your neighbors, we are committed to protecting the businesses and people in our community. We carefully select insurance companies that are both affordable and responsive.

- Comprehensive Protection: Our policies cover a wide range of cyber risks, from data breaches to public relations crises, ensuring your business is safeguarded from all angles.

- Dedicated Support: We offer personalized support and expert advice, helping you navigate the complexities of cyber threats and insurance coverage.

Are you finally ready to overcome your Cybersecurity challenges with a proper Cyber Liability Insurance? Want to discuss anything related to our services or partnerships, including potential collaborations and investment opportunities? This forum successfully encouraged people and products interested parties to participate in the survey, however, participants can also feel free to send email to our team directly: teamaismarketing@gmail.com

For immediate assistance. Whenever you feel free to reach out to us via our toll-free number: (877) 658-2472 any time, any day we will always be here for you the best and most reliable supplier you’ve been looking for. To embrace the essence and importance of AIS in your life, let’s connect and discover how can we meet your needs at the best level.

For any insurance products and services in Texas, Ohio, and any other state, get in touch with Advantage Insurance Solutions today and get the best insurance policies to fit your needs. It is never too soon to protect your company—get your cyber liability insurance from us right now.

Work Zone Safety for CMV Drivers

For large trucks and buses with a gross vehicle weight or gross combination weight of 10,001 lbs or more, the Federal Highway Administration (FHWA), the Federal Motor Carrier Safety Administration, and the National Highway Traffic Safety Administration (NHTSA) use the...

Registering for a USDOT Number

USDOT Number: What Is It? Companies that drive commercial vehicles in interstate commerce to carry people or move goods must register with the FMCSA and obtain a USDOT number. Commercial intrastate hazardous material carriers must also register for a USDOT Number if...

Keeping Your Vehicle Maintenance BASIC Scores Low

Did you realize that 900 different violations can impact a CSA score? The most important factors are the number, severity, and timeliness of a driver or carrier's offenses, whether they were for reckless driving, a poorly maintained vehicle, drug use, or excessive...

Summer Driving Hazards

Summer is a time when many people look forward to having fun, relaxing, and spending time with their families. Nobody goes on a summer vacation or a road trip expecting to get hurt. Unfortunately, numerous summer driving hazards can quickly turn a fun outing into a...

Truckload Driver Pay Increased to Nearly $70,000 in 2021

The American Trucking Association (ATA) released the findings of its 2022 ATA Driver Compensation Study on Wednesday (Aug. 10), in which more than 135,000 drivers and nearly 20,000 independent contractors were asked about their compensation, including pay rates,...

Driving Personal Cars for Business Use – A Good Idea?

You probably already use your car for work if you're an entrepreneur, contractor, or small business owner. If you are an employee, you must choose between driving your vehicle and using one provided by your employer. The choice is more complicated than simply deciding...

Importance of Defensive Driving Tests for Employees

Remember that you and the other drivers on the road are only human, and humans make mistakes. A defensive driver is not only concerned with his or her actions but also with anticipating the actions of other road users. Are you a business owner? Do you want to protect...

Bridge Your Auto Policy Gap with Drive-other-car Coverage

If you provide company vehicles to your employees and they do not have their automobile insurance policy, there may be a coverage gap. This endorsement actively bridges the commercial auto liability insurance coverage gap, ensuring your safety. How far would you go to...

Medical Certification Requirements for CDL Drivers

The Federal Motor Carrier Safety Administration (FMCSA) recently amended its regulations (FMCSRs) to require interstate commercial driver's license (CDL) holders who are subject to the physical qualification requirements of the FMCSRs to provide the State Driver...

Condominium Insurance: Protecting Your Unique Homeowner Needs

Owning a condominium offers a unique lifestyle with the perks of homeownership and the convenience of shared amenities and maintenance. However, with this unique living arrangement comes a distinct set of insurance needs. Condominium insurance is specially designed to...

Identity Theft Insurance: Safeguarding Your Good Name

In today's interconnected world, identity theft has become a prevalent menace, posing a significant risk to our personal information and financial well-being. To counter this threat, identity theft insurance emerges as a formidable defence, providing comprehensive...

What exactly is underinsured motorist coverage?

If an uninsured driver hits you, underinsured motorist coverage will assist in covering your expenses. Some states bundle uninsured and underinsured motorist coverages together as a single coverage on your auto policy. Each state has its definition of "underinsured."...

Understanding Dwelling Fire Coverage for Rental and Investment Properties

As a landlord or property investor, protecting your rental and investment properties is of paramount importance. While homeowners insurance is suitable for owner-occupied properties, it may not provide adequate coverage for rental or investment properties. This is...

Cyberbullying and Homeowners Insurance: Understanding the Risks and Coverage Options

As the digital world becomes an integral part of our daily lives, the risk of cyberbullying has emerged as a pressing concern for homeowners. Cyberbullying, defined as the use of electronic communication to harass, intimidate, or harm individuals, can have devastating...

Homeowners Insurance Market Outlook for 2023: Navigating a Complex Landscape

As we step into the year 2023, the homeowners insurance market finds itself in a state of dynamic change. The landscape is shaped by evolving risks, emerging technologies, and shifting consumer expectations. Navigating this complex market requires homeowners and...

Understanding the NCCI Remuneration Rule in Workers’ Compensation Insurance

Workers' compensation insurance is a critical safety net that protects both employers and employees in the event of workplace injuries or illnesses. To ensure fairness and consistency in the calculation of premiums, the National Council on Compensation Insurance...

The Rise of Work-from-Anywhere: A Future Outlook for Business Owners

In recent years, a transformative shift has been reshaping the landscape of work culture - the rise of work-from-anywhere. Driven by advancements in technology and changing employee preferences, this flexible work arrangement has gained momentum, particularly in the...

Enhancing Your Insurance Coverage: Hidden Factors You Might Be Overlooking

Insurance coverage plays a crucial role in protecting individuals and businesses from unforeseen risks. While many people recognize the importance of having insurance, they often overlook hidden factors that can significantly impact their coverage. In this blog, we...

The Defensive Driving Process

Driving is, without a doubt, an essential part of our ability to be self-sufficient. Good driving skills are required for safe travel. However, learning to drive is a difficult task, and we may encounter numerous problems while driving on roads. People must be aware...

Shopping for Auto Rates

If you don't have the cash to buy a car, it may seem impossible, but an auto loan can help you get reliable transportation. An auto loan is secured by a car and allows you to pay in fixed monthly instalments rather than all at once. By charging you less...

What Is Garage Liability Insurance?

Automobile dealerships, parking lot or parking garage operators, tow-truck operators, service stations, and customization and repair shops will add garage liability insurance to their business liability coverage. The policy covers property damage and bodily injury...

HOMEOWNERS: Safeguarding Your Home with Adequate Coverage

INSURANCE TO VALUE Choosing the right amount of coverage for your home is a critical decision regarding your homeowner's policy. Your home is more than just a place to live; it's your most valuable asset. You may need proper coverage to rebuild after a total loss....

Insurance for Domestic Help: Protecting Your Liabilities

How can you protect your liabilities with insurance for domestic help? When hiring help in your home, it's important to consider increasing your insurance coverage to safeguard against potential liabilities. This may include obtaining additional liability coverage,...

Benefits of Bundling Insurance Policies

Apply For ERC Now! All your insurance policies are designed to protect you financially, but did you know that keeping your coverage with the same provider can provide you with an additional bundled discount? Benefits of Bundling Insurance Policies Most personal...

Insuring Your College Student: Important Considerations

Contact Us To Apply For ERC! When your child prepares to leave for college, reviewing your insurance coverage is crucial to ensure adequate protection during this new phase of their life. Understanding how your coverage may change and taking proactive steps can help...

Are You Prepared? Protecting Your Home from Wildfires

Homeowners often face the risk of wildfires, which can be triggered by lightning strikes or accidents, spreading rapidly and engulfing brush, trees, and homes. It is crucial to make adequate preparations to minimize risk and protect your family and property during...

The Impact of AMA’s New Classification on Obesity: How It Affects Your Bottom Line

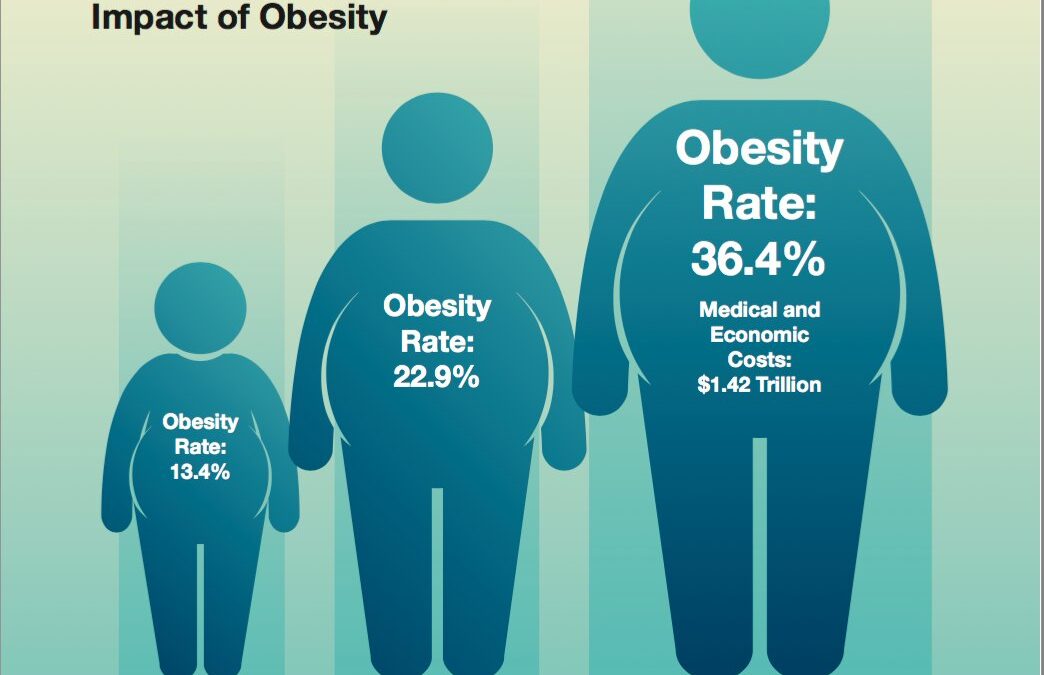

Obesity has long been recognized as a significant health concern, affecting individuals and communities worldwide. Recently, the American Medical Association (AMA) made a significant update to its classification of obesity, shedding new light on the severity and...

Understanding Claim Reserves: A Key Aspect of Workers’ Compensation

Insurers must establish claim reserves when managing workers' compensation claims within an organization. These reserves serve as designated funds to cover the anticipated costs of such claims. It is essential for insurers and organizations alike to accurately...

Frequency of Vehicle Thefts

According to the Hot Wheels Report and the 2021 Hot Spots Report from the National Insurance Crime Bureau (NICB). In the United States, Bakersfield, California, has the greatest rate of auto theft, according to the National Insurance Crime Bureau's 2021 Hot Spots...

Understanding Cumulative Trauma Injuries and Their Prevention

Cumulative trauma injuries pose significant organizational challenges, often resulting in complex and costly workers' compensation claims. Unlike acute injuries, cumulative trauma injuries develop gradually over time due to repetitive movements, making them more...

Building Effective Relationships with Medical Providers in Workers’ Compensation

Building Effective Relationships with Medical Providers in Workers' Compensation When dealing with a workers' compensation claim in your organization, it is essential to provide strong support for the recovery of the affected employee. Establishing a solid...

Commercial Auto Sees Best Results in a Decade, but Future Profits Remain Uncertain

The Governing Body of the ILO decided to hold a technical discussion on the future of work in the automotive sector and the need to invest in people's capacities as well as decent and sustainable work during its 335th Session. In the light of ILO's Centennial...

10 Facts About Distracted Driving

About Distracted Driving Did you know about 3,000 people die from distracted driving in a year? If you are aware of what distracted driving is, you may be mindful of what distracted driving is. Everyone should understand what distracted driving is and what causes it...

Protecting Commercial Property Against Hail

Hail can be a significant weather worry everywhere in the world. Mass deviation can be caused by ice pellets that are as small as a pea or as large as a golf ball. Strong winds and hail can cause extensive damage that could cost thousands of dollars to fix. This...

Driving in Extreme Weather

All drivers encounter adverse weather conditions at some point. Unfortunately, many people underestimate the modifications to driving style that are necessary. According to statistics and research conducted in the US, 24% of all crashes take place in inclement...

Understanding the Care, Custody or Control Exclusion

American drivers see a lot on their travels, travelling more than 13,000 miles a year on average. It's also one of the last locations you want to run into furry pals when you're moving at 40, 50, or even 60 mph or more. We rarely take the time to evaluate the scope of...

The Essential Insurance Coverage for Liquor Store Owners in the USA: Protecting Your Business and Customers

As a liquor store owner in the USA, it's essential to have the right insurance coverage to protect your business from potential risks and liabilities. Liquor stores face unique risks and challenges that require specialized insurance coverage to ensure that your...

Beware of Animals on the Road

American drivers travel more than 13,000 miles per year on average, so they see a lot on their trips. It's also one of the last locations you want to run into animal pals when travelling at speeds of 40, 50, or even 60 or more mph. Although it poses a severe safety...

Strategies for Managing Insurance Costs and Maintaining Adequate Coverage for Your Liquor Store

Owning a liquor store can be a lucrative business, but it also comes with its own set of risks and challenges. One of the most significant risks is the possibility of liquor liability claims, which can be costly and damaging to your business's reputation. Therefore,...

The Importance of Liquor Liability Insurance for Liquor Store Owners: Protecting Your Business and Your Customers

Liquor stores are an essential part of the community, providing customers with a wide range of alcoholic beverages. However, with the sale of alcohol comes the responsibility of ensuring that customers do not cause harm to themselves or others while under the...