Introduction to Errors and Omissions Insurance

Denver, CO is a city that does not count on luck and hope to succeed, but ensures trust and reliability in every business. However, regardless of the level of professionalism, level of training, or sheer years of experience that you and your team possess underneath your belt, errors could be committed. It is actually not a matter of arguing with being able to do it itself; it is a mere realization of human tendency. That is where Errors and Omissions Insurance (E&O Insurance) steps in, helping a business to survive in the competitive market.

Imagine this: this recognising that due to the slightest of clerical errors, a little mistake by an employee, then a company has to pay so dearly, their clients’ reputations are at stake too. No matter whether you had a justification for it or not, the prospects of a legal action might be rather high. While your standard business liability insurance policy may provide coverage for any bodily injury, property damage, or advertising injury, what happens when an error or omission occurs that is not caught and results in harm to your company and its clients? To safeguard your business, you can walk into Advantage Insurance Solutions with your business issues with confidence and get covered by an Errors and Omissions Insurance policy.

Understanding Errors and Omissions Insurance

Errors and Omissions Insurance also referred to as Professional Indemnity Insurance is a liability insurance product that offers protection to business entities, employees, and professionals against legal actions arising from alleged acts of negligence or failure in performance. It normally contains both the fees of the court and any awards up to the amount of the insurance premium, making it one of the most effective financial safeguards for service providing companies.

Key Takeaways of Errors and Omissions Insurance:

- Comprehensive Coverage: Business and professionals can obtain E&O Insurance that protects them from claims of negligence as well as shoddy work from their customers.

- Essential for Service Providers: Not a single business entity that involves the provision of services for monetary remuneration such as medical practitioners, legal practitioners, certified public accountants, quantity surveyors, project managers, event planners, wedding planners, and so on should be without E&O Insurance.

- Broad Applicability: We now come to E & O Insurance that in its broad sense is indispensable to many professions comprising financial services and medical services among others, and which affords protection against different professional risks.

Why Denver Businesses Need Errors and Omissions Insurance

A demanding environment and numerous businesses make Denver’s economy one of the most diverse and promising yet risky for numerous sectors. Whether you are an IFPA member working on administrative levels dealing with unclear legislation or a wedding planner, a real estate agent who makes deals with valuable properties, the Errors and Omissions Insurance is your protection.

Protect Against Costly Lawsuits

Consider this scenario: This case involves a situation where a client takes legal action against a financial advisor after an investment turns out to be a bad one, even though the nature of such risks in the chosen investment option was clearly explained and fell within acceptable guidelines. While monitoring this particular aspect was outside of Markoff and Hopp’s technical expertise, even if the court were to rule in the advisor’s favor, the legal fees are staggering. About E&O Insurance, this is the insurance that will shield you from such financial loss hence making your business to remain active and your business integrity to remain strong.

Tailored Coverage for Specific Needs

E&O Insurance isn’t one-size-fits-all. At Advantage Insurance Solutions, we understand that each industry faces unique risks. That’s why our policies are customizable, ensuring you get the coverage that best fits your needs. Whether you’re a real estate agent, a printing company, or a consultant, our E&O Insurance provides robust protection tailored to your specific risks.

Advantages of Errors and Omissions Insurance

Comprehensive Protection: E&O Insurance covers a wide range of potential liabilities, from simple clerical errors to major oversights, providing peace of mind and financial security.

- Legal Cost Coverage: Legal fees can be a significant burden, even if you win a case. E&O Insurance covers court expenses and settlements, safeguarding your financial health.

- Industry-Specific Policies: Different industries have different risks. Our policies are tailored to meet the specific needs of various fields, ensuring comprehensive protection.

- Global Coverage: Many of our policies offer worldwide coverage, provided claims are filed in the U.S., its territories, or Canada.

- Coverage for All Employees: E&O Insurance typically covers business owners, salaried and hourly employees, and subcontractors working on behalf of the business.

- Past Work Coverage: Our policies can cover unforeseen claims arising from work completed before you were even insured, offering an added layer of protection.

Example of Errors and Omissions Insurance in Action

Imagine a server-hosting company in Denver suffering a data breach, exposing sensitive client information. The affected companies sue for damages due to inadequate security measures. With an E&O Insurance policy from Advantage Insurance Solutions, the server-hosting company can cover legal expenses and settlements, preventing financial ruin and maintaining client trust.

Why Choose Advantage Insurance Solutions for Your Errors and Omissions Insurance

At Advantage Insurance Solutions, we believe in more than just providing insurance; we believe in building lasting relationships with our clients. Here’s why we stand out:

- Personalized Service: We’re not just your insurance provider; we’re your neighbors. We understand the local business landscape in Denver and tailor our services to meet your specific needs.

- Expert Guidance: Our knowledgeable agents are dedicated to helping you forge the strongest shield possible. We carefully choose the insurance companies we represent to ensure they are both affordable and responsive.

- Flexible Payment Options: We offer monthly payment plans to help manage your cash flow effectively, making it easier to maintain the coverage you need.

- Responsive Claims Handling: In the event of a claim, time is of the essence. Our team is committed to providing swift and effective claims responsiveness to minimize disruption to your business.

- Tailored Coverage: We understand that no two businesses are alike. Our E&O policies are customized to address the specific risks of your industry, ensuring comprehensive protection.

- Comprehensive Solutions: From covering temporary staff and subcontractors to past work and worldwide claims, our policies are designed to provide all-encompassing protection.

Welcome to Advantage Insurance Solutions: We are here to cover your assets, which you have grown for years. Whether you are ready to talk about your Errors and Omissions Insurance policies with us or consider other types of insurance, we are always ready to assist with helping you.

Want to talk to us about collaborating or any other offers?

Send us an email at teamaismarketing@gmail.com.

Just getting the cheapest insurance is not enough since there are numerous factors involved. It is more about paying your premium a and getting a policy that will take care of you when you get half. At Advantage Insurance Solutions, we provide insurance solutions accompanied with a range of bundle services that will give our clients the best three attributes, namely; protection, reassurance, and choice. We are here to explain how Easy and Convenient Errors and Omissions Insurance works and to ensure your business’ protection.

For immediate assistance. Whenever you feel free to reach out to us via our toll-free number: 1 877 658 2472), at We offer you help and the service our clients require. Please give me the opportunity to fulfill that need and show you how Advantage Insurance Solutions can meet your needs.

Cyberbullying and Homeowners Insurance: Understanding the Risks and Coverage Options

As the digital world becomes an integral part of our daily lives, the risk of cyberbullying has emerged as a pressing concern for homeowners. Cyberbullying, defined as the use of electronic communication to harass, intimidate, or harm individuals, can have devastating...

Homeowners Insurance Market Outlook for 2023: Navigating a Complex Landscape

As we step into the year 2023, the homeowners insurance market finds itself in a state of dynamic change. The landscape is shaped by evolving risks, emerging technologies, and shifting consumer expectations. Navigating this complex market requires homeowners and...

Understanding the NCCI Remuneration Rule in Workers’ Compensation Insurance

Workers' compensation insurance is a critical safety net that protects both employers and employees in the event of workplace injuries or illnesses. To ensure fairness and consistency in the calculation of premiums, the National Council on Compensation Insurance...

The Rise of Work-from-Anywhere: A Future Outlook for Business Owners

In recent years, a transformative shift has been reshaping the landscape of work culture - the rise of work-from-anywhere. Driven by advancements in technology and changing employee preferences, this flexible work arrangement has gained momentum, particularly in the...

Enhancing Your Insurance Coverage: Hidden Factors You Might Be Overlooking

Insurance coverage plays a crucial role in protecting individuals and businesses from unforeseen risks. While many people recognize the importance of having insurance, they often overlook hidden factors that can significantly impact their coverage. In this blog, we...

The Defensive Driving Process

Driving is, without a doubt, an essential part of our ability to be self-sufficient. Good driving skills are required for safe travel. However, learning to drive is a difficult task, and we may encounter numerous problems while driving on roads. People must be aware...

Shopping for Auto Rates

If you don't have the cash to buy a car, it may seem impossible, but an auto loan can help you get reliable transportation. An auto loan is secured by a car and allows you to pay in fixed monthly instalments rather than all at once. By charging you less...

What Is Garage Liability Insurance?

Automobile dealerships, parking lot or parking garage operators, tow-truck operators, service stations, and customization and repair shops will add garage liability insurance to their business liability coverage. The policy covers property damage and bodily injury...

HOMEOWNERS: Safeguarding Your Home with Adequate Coverage

INSURANCE TO VALUE Choosing the right amount of coverage for your home is a critical decision regarding your homeowner's policy. Your home is more than just a place to live; it's your most valuable asset. You may need proper coverage to rebuild after a total loss....

Insurance for Domestic Help: Protecting Your Liabilities

How can you protect your liabilities with insurance for domestic help? When hiring help in your home, it's important to consider increasing your insurance coverage to safeguard against potential liabilities. This may include obtaining additional liability coverage,...

Benefits of Bundling Insurance Policies

Apply For ERC Now! All your insurance policies are designed to protect you financially, but did you know that keeping your coverage with the same provider can provide you with an additional bundled discount? Benefits of Bundling Insurance Policies Most personal...

Insuring Your College Student: Important Considerations

Contact Us To Apply For ERC! When your child prepares to leave for college, reviewing your insurance coverage is crucial to ensure adequate protection during this new phase of their life. Understanding how your coverage may change and taking proactive steps can help...

Are You Prepared? Protecting Your Home from Wildfires

Homeowners often face the risk of wildfires, which can be triggered by lightning strikes or accidents, spreading rapidly and engulfing brush, trees, and homes. It is crucial to make adequate preparations to minimize risk and protect your family and property during...

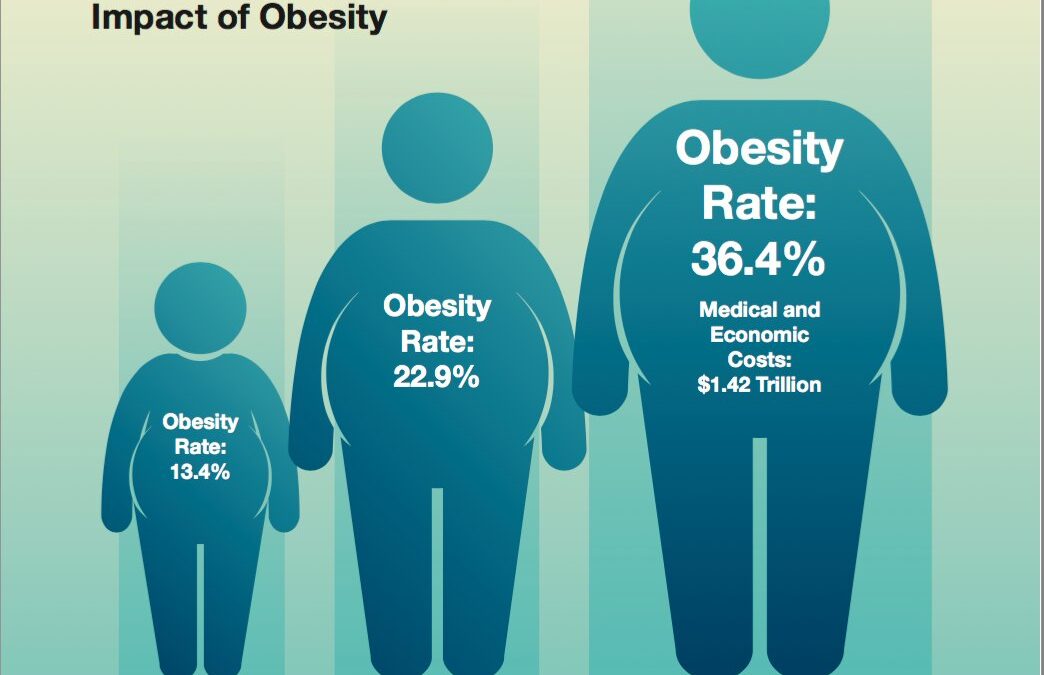

The Impact of AMA’s New Classification on Obesity: How It Affects Your Bottom Line

Obesity has long been recognized as a significant health concern, affecting individuals and communities worldwide. Recently, the American Medical Association (AMA) made a significant update to its classification of obesity, shedding new light on the severity and...

Understanding Claim Reserves: A Key Aspect of Workers’ Compensation

Insurers must establish claim reserves when managing workers' compensation claims within an organization. These reserves serve as designated funds to cover the anticipated costs of such claims. It is essential for insurers and organizations alike to accurately...

Frequency of Vehicle Thefts

According to the Hot Wheels Report and the 2021 Hot Spots Report from the National Insurance Crime Bureau (NICB). In the United States, Bakersfield, California, has the greatest rate of auto theft, according to the National Insurance Crime Bureau's 2021 Hot Spots...

Understanding Cumulative Trauma Injuries and Their Prevention

Cumulative trauma injuries pose significant organizational challenges, often resulting in complex and costly workers' compensation claims. Unlike acute injuries, cumulative trauma injuries develop gradually over time due to repetitive movements, making them more...

Building Effective Relationships with Medical Providers in Workers’ Compensation

Building Effective Relationships with Medical Providers in Workers' Compensation When dealing with a workers' compensation claim in your organization, it is essential to provide strong support for the recovery of the affected employee. Establishing a solid...

Commercial Auto Sees Best Results in a Decade, but Future Profits Remain Uncertain

The Governing Body of the ILO decided to hold a technical discussion on the future of work in the automotive sector and the need to invest in people's capacities as well as decent and sustainable work during its 335th Session. In the light of ILO's Centennial...

10 Facts About Distracted Driving

About Distracted Driving Did you know about 3,000 people die from distracted driving in a year? If you are aware of what distracted driving is, you may be mindful of what distracted driving is. Everyone should understand what distracted driving is and what causes it...

Protecting Commercial Property Against Hail

Hail can be a significant weather worry everywhere in the world. Mass deviation can be caused by ice pellets that are as small as a pea or as large as a golf ball. Strong winds and hail can cause extensive damage that could cost thousands of dollars to fix. This...

Driving in Extreme Weather

All drivers encounter adverse weather conditions at some point. Unfortunately, many people underestimate the modifications to driving style that are necessary. According to statistics and research conducted in the US, 24% of all crashes take place in inclement...

Understanding the Care, Custody or Control Exclusion

American drivers see a lot on their travels, travelling more than 13,000 miles a year on average. It's also one of the last locations you want to run into furry pals when you're moving at 40, 50, or even 60 mph or more. We rarely take the time to evaluate the scope of...

The Essential Insurance Coverage for Liquor Store Owners in the USA: Protecting Your Business and Customers

As a liquor store owner in the USA, it's essential to have the right insurance coverage to protect your business from potential risks and liabilities. Liquor stores face unique risks and challenges that require specialized insurance coverage to ensure that your...

Beware of Animals on the Road

American drivers travel more than 13,000 miles per year on average, so they see a lot on their trips. It's also one of the last locations you want to run into animal pals when travelling at speeds of 40, 50, or even 60 or more mph. Although it poses a severe safety...

Strategies for Managing Insurance Costs and Maintaining Adequate Coverage for Your Liquor Store

Owning a liquor store can be a lucrative business, but it also comes with its own set of risks and challenges. One of the most significant risks is the possibility of liquor liability claims, which can be costly and damaging to your business's reputation. Therefore,...

The Importance of Liquor Liability Insurance for Liquor Store Owners: Protecting Your Business and Your Customers

Liquor stores are an essential part of the community, providing customers with a wide range of alcoholic beverages. However, with the sale of alcohol comes the responsibility of ensuring that customers do not cause harm to themselves or others while under the...

Understanding the Different Types of Insurance Coverage Available for Liquor Store Owners

Running a liquor store can be a lucrative business, but it's not without its risks. Whether you own a small independent shop or a large chain of stores, it's important to protect yourself from the unexpected. That's where insurance comes in. In this article, we'll...

How to Choose the Right Insurance for Your Pet Care Business

Introduction: As a pet care professional, you know that taking care of pets comes with risks. From accidents and injuries to liability claims, there are a lot of things that can go wrong. That's why having the right insurance is essential to protect your business and...

Umbrella Insurance for Pet Care Professionals: What It Is and Why You Need It

Running a pet care business can be incredibly rewarding, but it also comes with its fair share of risks. From bites and scratches to property damage and theft, pet care professionals face a range of liabilities daily. That's why many pet care professionals invest in...

Trends and Predictions for the Future of Pet Care Professional Insurance

Pet Care Professional Insurance Future Trends Predictions are crucial for professionals like pet groomers and dog walkers who play an essential role in the lives of pet owners. As a pet care professional, you provide invaluable services that keep pets healthy, happy...

Pet Grooming Insurance: What You Need to Know

Introduction: As a pet groomer, your job involves taking care of your clients' furry family members. While you strive to provide the best care possible, accidents can happen, and you could find yourself facing a lawsuit. That's where pet grooming insurance comes in....

Cyber Liability Insurance for Pet Care Professionals: Protecting Your Business from Digital Threats

Introduction: As the pet care industry continues to expand, so does the reliance on technology to conduct day-to-day operations. From scheduling appointments to processing payments, pet care professionals are increasingly using digital platforms to manage their...

Professional Liability Insurance for Veterinarians

As a veterinarian, you have a responsibility to provide your patients with the best possible care. However, no matter how experienced or skilled you are, accidents and mistakes can happen. That's why it's essential to have professional liability insurance to protect...

Cost of a Single Fatality Up 60% Since 2010

In 2020, with 4,764 reported fatal work injuries, a 10.7% decrease from 2019's 5,333, according to the Bureau of Labor Statistics. Notably, sourced from the Census of Fatal Occupational Injuries. Moreover, the rate dropped from 3.5 to 3.4 per 100,000 FTE workers in...

Types of Coverage for Pet Care Professionals’ Insurance

Introduction: If you are a pet care professional, you know how important it is to provide the best care possible for your furry clients. However, accidents and injuries can happen despite your best efforts, which is why having the right insurance coverage is...

Common Misconceptions About Pet Care Professional Insurance

Introduction: As a pet care professional, whether you are a dog walker, pet sitter, or groomer, you are likely aware of the importance of having insurance coverage. However, some common misconceptions about pet care professional insurance might still be leaving you...

Understanding the Factors that Affect Workers’ Compensation Insurance Premiums

Introduction: Workers' compensation insurance is designed to protect employees who are injured or become ill while on the job. It is a mandatory insurance policy that provides medical care and wage replacement to employees who suffer work-related injuries or...

Ethics in Workers’ Compensation Claims: A Guide for Employers

Introduction: Workers' compensation claims can be a difficult and sensitive issue for employers to handle. Not only do they have to navigate the legal process, but they also have to consider the ethical implications of their actions. In this article, we'll explore the...

Revolutionizing Workers’ Compensation: The Power of Technology

Introduction: The world is changing, and technology is playing an increasingly important role in many aspects of our lives. One area that is being revolutionized by technology is workers' compensation. As we look to streamline the process and improve outcomes for...

The Crucial Role of Medical Professionals in Workers’ Compensation Claims

When a worker sustains an injury or illness on the job, the process of filing a workers' compensation claim can be overwhelming and confusing. One critical aspect of this process is the role of medical professionals, who play a crucial role in the care and treatment...

Workers’ Compensation vs Liability Insurance

As a business owner, it's important to understand the different types of insurance available to protect your business and employees. Two commonly confused types of insurance are workers' compensation insurance and liability insurance. Both are designed to protect your...

Navigating Workers’ Compensation Claims: A Guide for Employers

Workers' compensation claims can be a complex and confusing process for employers. Ensuring compliance with regulations while managing claims can be a daunting task. However, businesses need to understand how to manage these claims to protect their employees and their...

Auto insurance for food delivery services

Owning a restaurant and providing meal delivery pose significant risks. However, the benefits of delivery, such as higher customer and revenue counts, outweigh these risks. Fortunately, you can control those risks by purchasing commercial auto insurance, which shields...

Workers’ Compensation Insurance: Protecting Employers and Employees

Workplace accidents and injuries are common occurrences in any industry. While it is the employer's responsibility to provide a safe working environment, accidents can still happen. In such cases, workers' compensation insurance provides a safety net for both...