What is Cyber Liability Insurance?

Cybersecurity is a significant issue affecting businesses of all sizes and in the modern world where Companies majorly rely on technology, these threats are so real. That is why at Advantage Insurance Solutions, we truly appreciate the fact that the protection against these risks is a matter of primary concern for any company. In this policy we cover Cyber Liability which offers substantial protection against data breach and other forms of cyber related crimes, thereby giving your business the necessary strength and ability to withstand such risks.

Cyber liability insurance is not just about having a piece of paper with some impressively written words on it, it’s about having a tool to help protect your business. It provides a combination to coverage that suits an organization to protect against the financial and brand damage of cyber threats. Cybersecurity is one of the most important sections to address when engaging in digital business because it is not a matter of if you will get hit by a cyber threat, but when. Cyber Liability Insurance is an essential protective measure your business needs to incorporate as soon as today.

Real-World Impact of Cyber Threats

An example is the Rokenbok toy firm that is confronted with a real-life cyber attack in the middle of the rush for the holiday seasons. Computer hackers demanded money from the company as they had kidnapped its files through an act of cyber theft which involved encrypting all its information. This breach resulted to significant losses made when executing the orders. Worse still, this was not the first time the company had experienced an attack or a hack, a cyber incident. Earlier in the year, for instance, they were Locked out of their site by an attack known as Denial of Service.

Paul Eichen, CEO of Rokenbok, described the harrowing experience in an interview with the New York Times: This was one that made me work it out. ” To the customers, initial perceptions are very important and it took the company four days to rebuild its data base while the hackers were never apprehended.

Rokenbok’s experience is typical for any organization that relies on computers and electronic data meaning business results, taxes, invoices, or any other information that needs protection. 90% of companies that lose data for more than a week are doomed to failure since the process of recovering these losses is very expensive. Also, if your system holds firm data relative to the clients, employees, or vendors, it may cause lawsuits and high costs in case of the data leakage.

The Necessity of Cyber Insurance

Let’s take a look at why every business – whether small, medium, or large – should consider getting Cyber Liability Insurance. This coverage will pay for the costs incurred in cases of data breaches and the likes under cyber risks. Accompanying laws that virtual states impose towards businesses to inform the affected people of data breaches make it even more imperative to need a cyber liability policy.

More specifically, at Advantage Insurance Solutions, we have a policy known as cyber liability, meant to protect companies from the financial risks emerging from data theft and other cyber related calamities. We have several options which are included in the policies such as the first and third party options among which some are standard while you can opt for the others depending on your requirements.

First-Party and Third-Party Coverages

First-party losses include all the costs that your business faces in the direct wake of a breach. This includes expenses connected with the notification of customers that there was an attempt at hacking the company’s network. Third-party liabilities cover those claims which may be filed against your business by any other party that was impacted by your cyber event, like a client suing you for negligence, given that the criminals involved in cyber examines stole his/her data that you stored in your system.

Comprehensive Protection with Cyber Insurance

With a well-rounded cyber liability policy from Advantage Insurance Solutions, you can feel confident in your coverage against data breaches and related issues. Here’s what our comprehensive policy includes:

- Data Compromise Protection: Covers employee and customer information if your data is hacked, stolen, corrupted, or compromised due to internal fraud.

- Legal Cost Protection: Covers costs incurred from legal reviews.

- Forensic Services: Helps determine the nature, extent, and perpetrators of a breach.

- Personal Services: Provides helpline services, credit monitoring, and case managers for identity theft victims.

- Public Relations Costs: Pays for firms to manage the potential impact of a data compromise on your company’s reputation.

- Legal Defense Costs: Covers expenses if your company is sued due to a breach.

- Identity Recovery Protection: Assists in restoring the credit history and records of identity fraud victims, including owners, employees, and family members.

Who Needs Cyber Insurance?

Any business, firm or organization that has embraced technology in their operations faces the risk of cybercrimes. Essential for any business, Cyber Liability Insurance is a vital for both international companies and small businesses located in the territory of your country. Currently, as we realize improvements in the different aspects of the technology world, it is to be expected that the varieties of threats to the cyberspace will also increase in the future. Hence, it is essential for businesses to have sufficient coverage in cyber liability insurance as well as develop sound cybersecurity measures to counter these risks.

Why Choose Advantage Insurance Solutions?

At Advantage Insurance Solutions, we go beyond offering generic insurance products. We understand that each business has unique needs and risks. Here’s why partnering with us is the best choice for your cyber liability insurance needs:

- Tailored Coverage: We don’t believe in one-size-fits-all policies. Our team works closely with you to understand your business and structure a policy that provides the specific protection you need.

- Local Expertise: As your neighbors, we are committed to protecting the businesses and people in our community. We carefully select insurance companies that are both affordable and responsive.

- Comprehensive Protection: Our policies cover a wide range of cyber risks, from data breaches to public relations crises, ensuring your business is safeguarded from all angles.

- Dedicated Support: We offer personalized support and expert advice, helping you navigate the complexities of cyber threats and insurance coverage.

Are you finally ready to overcome your Cybersecurity challenges with a proper Cyber Liability Insurance? Want to discuss anything related to our services or partnerships, including potential collaborations and investment opportunities? This forum successfully encouraged people and products interested parties to participate in the survey, however, participants can also feel free to send email to our team directly: teamaismarketing@gmail.com

For immediate assistance. Whenever you feel free to reach out to us via our toll-free number: (877) 658-2472 any time, any day we will always be here for you the best and most reliable supplier you’ve been looking for. To embrace the essence and importance of AIS in your life, let’s connect and discover how can we meet your needs at the best level.

For any insurance products and services in Texas, Ohio, and any other state, get in touch with Advantage Insurance Solutions today and get the best insurance policies to fit your needs. It is never too soon to protect your company—get your cyber liability insurance from us right now.

Sexual Harassment in the Workplace and EPLI Insurance

We have all heard about sexual harassment in the workplace. We see it on television and we hear about it in the news. But what does the possibility of a sexual harassment lawsuit mean for a company or a business? What are the implications when a supervisor or even a...

How To Promote Road Safety

Safe Driving Habits: How to Encourage and Promote Responsible Driving Driving your own car for the first time gives hype and excitement to explore the road. No wonder new drivers often encounter accidents. Even old drivers are not exempted from road accidents that...

Digital Tools To Super Boost Agency Growth

Digital Acceleration and Transformation Advantage Insurance Solutions has always been an old-school agency operating traditionally with pen and paper and face-to-face interactions. As an independent insurance agency in Denver, CO, this gave the company the chance to...

9 Useful Tools for Professional Groomers of Dogs and Cats

Grooming pets can be a hassle sometimes, especially for busy pet owners who have a lot on their plate to deal with. Whether it is for dogs or cats, Pet Groomers in Denver, Colorado, and everywhere else have the most effective tools to ensure that they give the best...

Top 9 Grocery Delivery Within An Hour: Alternatives to Instacart

Why I Chose Grocery Delivery Services I love cooking. And I really love cooking with fresh, healthy ingredients. The only thing I don't love? Grocery shopping. It's not that I hate the grocery store—it's just that there are so many other things I'd rather do on a...

9 Best Home Security Tips 2023

Best Home Security Tips The best home security tips can help you protect your house from robbers and thieves. Advantage Insurance Solutions provide instructions or how-to’s essential to landscaping, lighting, and other tips to help prevent theft. Spread the...

What Is The Purpose of Having an Independent Insurance Agent?

Enrico and Joseph Enrico is in the insurance industry working as an independent agent. His experience goes back at least twelve years when he was still an exclusive or captive agent. This is for one of the more prominent life insurance agencies. He has gained several...

A Brand New Business

A Brand New Business I have a new idea for a new show so let's forget about "Shameless," "Breaking Bad," or even "Game of Thrones." In addition, I don't know yet where the show will appear or who will even produce it, but I'm sure it will be a huge hit. Moreover, I...

Shipt Drivers in Colorado 2023

So, I finally did it! I decided to give Shipt a go a few months back. And, see if it lives up to the hype that my working mom and professional girlfriends were all claiming and raving about. And, oh dearie my! They were absolutely on point about Shipt drivers! I am...

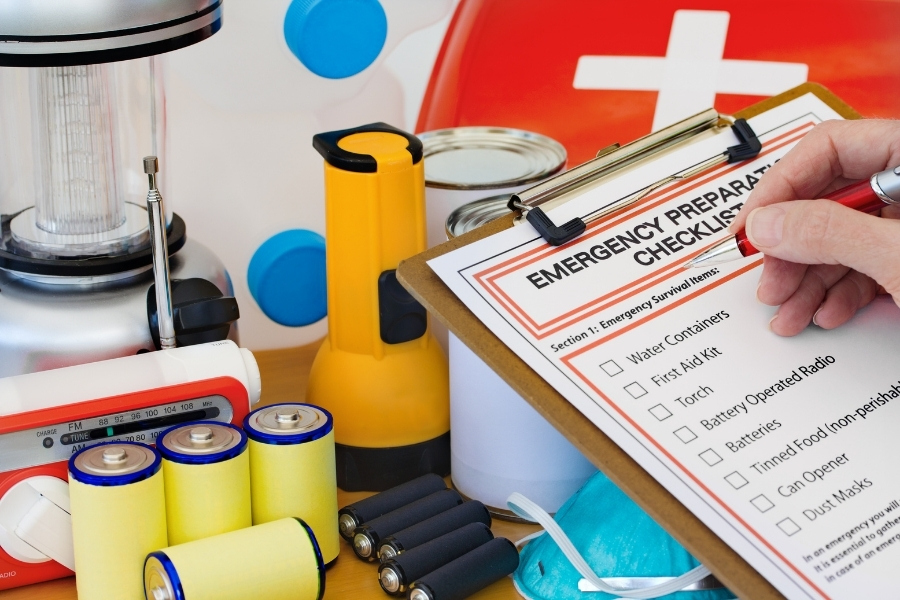

Basic Survival Equipment

No one is exempted when a disaster strikes, and the likelihood of one's survival could depend on how well-prepared one is in such scenarios. What kind of preparation does this entail? First, doing some research on what kind of disasters are likely to happen in your...

Smart Home Technology Products For Your Remodel

Smart Home Technologies for Your Remodel These are some of the most common reasons why people do whole renovations of their homes. Some homeowners start with the kitchen and bathroom first since these parts of your home need maintenance. Today we find out about new...

Lower Your Homeowners Insurance with Smart Home Technology

Do you know that new smart technologies and smart gadgets can help you lower your homeowner’s insurance premium? So today, we will discuss the benefits and risks of smart home technologies. To contact our insurance specialists, just click here and complete the form....

Top 9 Grocery Delivery Within An Hour: Alternatives to Instacart

Top 9 Grocery Delivery Services of 2022 Here are the top 9 grocery delivery within an hour and alternatives to Instacart. These are also going into 2021 and now 2022 which could help you get food at home. Now, the top grocery delivery service would bring fresh...

Safety Tips When Swimming In The Pool

Are you one of the lucky ones who have a pool in your own house? As summer comes, cooling off in a pool is one of the fun outdoor activities that you can enjoy with the whole family. However, as a homeowner or a parent, one of your responsibilities is to take...

Smart Alarm For Houses: What Is It And Do I Need It?

According to the Federal Bureau of Investigation, seven years ago, criminals committed 8.2 million property crimes in the United States. And 21% of these crimes are burglaries. Looking at these ratings, it is a no-brainer why people always think of home security...

Smart Home Technology and Cybercrime

Have Your Home Secured Home security systems might be one of the best investments you will ever make for your home. You protect your home at the same time you give yourself peace of mind. It deserves knowing that you can control it. And, monitor the security in your...

Have A Safe and Merry Christmas: A Christmas Tree Safety Tip

The holidays are fast approaching. Anywhere in the world, a sudden cold breeze will soon cover the land. It's time to pull out your winter coats, grab a pumpkin spice latte, and start thinking of how you will celebrate the holidays this year. Is everyone on your...

Home Generators: 10 Reasons Why You Should Get One

As we are all living in a world strongly dependent on gadgets and technology. This is why having a power interruption would not only interrupt our power supply but also disturb our day-to-day routine. It would branch out to different problems. Not just for you but the...

Safety Tips For Space Heaters

Safety Tips For Your Space Heater Heating has been a concept since the times of early mankind. Nobody knows when mankind was able to manufacture fire, but when they did, it was a means of comfort. But unlike the early man, we now also have to ensure safety when fire...

Gas Grill Fire

The grill has become a popular fixture at laid-back barbecues and neighborhood gatherings across the country. It’s already a custom here in the US. Grills, of course, still require regular maintenance even though it’s a convenient way to cook. It’s essential to be...

Disaster Recovery Planning Steps

Are You Prepared? As the word ‘Emergency’ means some kind of sudden, unforeseen, urgent that is needing immediate action or attention; this is definitely something everyone needs to be prepared for. We will discuss disaster recovery planning steps. We make it easy to...

Signs That Your Plumbing Has Problems

Unfixed plumbing problems can cause water damage in your home. It would take time and money to fix if this were left unfixed and ignored. Advantage Insurance Solutions discusses fixing plumbing problems. To contact our insurance specialists, just click here and...

Insurance Scams and How to Detect Them

Beware of these insurance scams! As per the latest FBI Reports, the insurance industry has more than seven thousand (7,000) companies that collect more than $1 Trillion each year. This incredible industry is, unfortunately as well the reason why insurance fraud is...

How to Insure my Home Properly: A Guide to Full Replacement Coverage

Underinsurance is one of the leading issues most American homeowners face. According to CoreLogic, a leading property data provider in the USA, Sixty-four percent of American homeowners are underinsured. Why is underinsurance a big deal for homeowners? Insufficient...

Pet Malpractice Insurance

Vets are still at risk of malpractice lawsuits. Although they only provide medical treatments to animals. More than 2,000 veterinarian malpractice cases are filed in the U.S. every year. In addition, practicing veterinary medicine comes with many risks as vets deal...

Comprehensive Guide to Commercial Property Insurance for 2023

Commercial Property Insurance Guide One of the best investments you can make is venturing into business. Putting up a business often requires vast capital. Moreover, business owners must invest in various assets like buildings and equipment. How can you do business...

Will Losses On My Workers’ Compensation Policy Impact My Premiums?

Workers’ compensation laws are quite complicated. Many business owners are at a loss on how workers comp rules and regulations work. A particular question insurance companies always get is, “Will losses on my workers’ compensation policy impact my premiums?”. Claims...

What is Private Client Insurance and How Do I Know if I Need It?

Who is a Private Client? Banks regard high-net-worth individuals as private clients. Moreover, these private clients are rich, wealthy individuals with significant financial portfolios. After, they often receive personalized services and products. Moreover, they also...

Does Your Business Need a Liquor Liability Policy?

People love to celebrate and have fun in bars and restaurants. In addition, alcohol brings life to parties, celebrations, and gatherings. But it can also cause fights and accidents. Also, did you know you’re liable for any alcohol-related incidents your customers may...

Car Insurance Trends in Colorado: Why Does It Feel Like My Rates Keep Increasing?

Every year, more and more car owners have noticed the trend of increasing car insurance rates in Colorado. There was an average $272 increase in car insurance premiums from 2015 to 2018. So, as with numerous car owners, you are probably wondering why your auto...

Why Does My Home Insurance Have Two Deductibles And What Are They For?

Every homeowners' insurance policy includes a deductible. Deductibles serve as a shared risk between the insurance provider and the homeowner. But have you ever wondered why you have two home insurance deductibles and what they’re for? Sign Up For A 5-min Check-up!...

Is My Home and Auto Insurance Tax Deductible?

Calculating and paying taxes is an essential yet stressful matter we must deal with every year. However, receiving the maximum tax refund is also an excellent opportunity. So while you are gathering all your tax papers, you might wonder if your home and auto insurance...

Professional Liability Coverage for Dental Professionals

Dental Malpractice Insurance for Dentists Malpractice insurance for a dentist is a requirement unless other kinds of optional insurance policies. You may need this insurance coverage to become a licensed practicing dentist. Your choice regarding malpractice insurance...

What is the Stated Value of auto insurance vs. Agreed Value or ACV?

Nowadays, cars are not just for travel purposes. Also, some people enjoy collecting classic, exotic, and antique cars. In addition, these types of cars have high value, and their value continues to increase over time. Regular car insurance will not suffice to protect...

Group Life Insurance Vs Individual Life Insurance

Many working people think that company-sponsored plans are enough to protect them financially. Moreover, having employer-provided life insurance is one of the best benefits a worker can get. Company-sponsored plans are good, but the coverage is often not enough. It is...

To buy or not to buy that is the question when it comes to Rental Car Damage Waiver

World Economic Forum lists Spain as one of the top tourist destination sites in the world. This is measured and ranked by their Travel and Tourism Competitiveness Index. In fact, France outdoes Spain when it comes to being the most visited country on the globe. And it...

Most Dangerous Roads and Intersections in Denver, CO

Denver's growing population and the number of inattentive drivers and pedestrians are some of the reasons why car accidents happen on the most dangerous roads and intersections in Denver, Colorado. Protect Yourself Now! 7 Most Dangerous Roads in Denver, Colorado...

Is your Property in Storage also Covered?

Owning a house is the best way you can protect your property. Protecting property from any unfortunate event is to secure it with a standard homeowners insurance policy. This gives you peace of mind about everything that you have inside your home. This includes your...

Home Equipment Insurance, Should I Add It To My Homeowner’s Policy?

What is equipment coverage? Do I need it? Should I include it in my homeowner’s policy? These are just some of the questions most people ask, especially now that technology and advanced home equipment have replaced old appliances. With high technology, most homes...

What Is The Difference Between Standard and Non-Standard Auto Insurance?

What is Auto Insurance? And, what is the difference between Standard and Non-Standard Insurance? Auto insurance is also car insurance, motor insurance, and vehicle insurance. Auto insurance is a type of insurance that protects you from out-of-pocket expenses for...