Small Business Insurance in Denver, CO

AIS: Your trusted partner in Denver, CO

As entrepreneurs ourselves, we understand the dedication and hard work you’ve invested in building your business. That’s why we’re here to offer tailored insurance solutions designed to mitigate risks and provide peace of mind, allowing you to focus on what matters most—growing your enterprise

Understanding the Need for Small Business Insurance

Denver, CO

In the heart of Denver, where innovation meets opportunity, your small business is not just a venture—it’s a testament to your dedication and vision. However, as you navigate the intricate web of commerce, you must recognize the importance of safeguarding your investment.

Small business insurance is a vital safeguard, protecting against risks that could otherwise jeopardize your entrepreneurial endeavors. Therefore, whether it’s safeguarding your property from unexpected damage or shielding you from liability claims that could arise from accidents or legal disputes, this insurance coverage is essential for ensuring the security and continuity of your business. Additionally, by investing in small business insurance tailored to your specific needs in Denver, CO, you can confidently navigate uncertainties, knowing that your valuable assets and aspirations are adequately protected.

In addition, the bustling metropolis of Denver, CO, small businesses are the lifeblood of the community, weaving a vibrant tapestry of economic activity. From cozy cafes to bustling food trucks, each entrepreneurial venture adds to the city’s dynamic landscape. However, with boundless opportunity comes inherent risk, making comprehensive insurance coverage imperative for safeguarding investments.

Therefore, at Advantage Insurance Solutions, we specialize in tailoring small business insurance solutions to meet the unique needs of Denver’s entrepreneurs. In summary, Whether you’re launching your business or have been established for years, our dedicated team is here to navigate the complexities of commercial insurance on your behalf. Plus, with our expertise, you can rest assured knowing your enterprise is protected, allowing you to focus on growth and prosperity.

Why It Matters

As a small business owner, you know success requires dedication and hard work. However, unexpected events can disrupt progress. That’s where small business insurance in Denver, CO, comes in. It protects against diverse risks, including:

Property Damage

Whether it’s fire, theft, or vandalism, property damage can disrupt your business operations and result in significant financial losses. Plus, with property insurance, you can rest assured that your physical assets are protected against unexpected perils

Liability Claims

In today’s litigious society, even the most careful business owners can face lawsuits from customers, employees, or third parties. Moreover, liability insurance covers legal fees, settlements, and judgments arising from claims of bodily injury or property damage.

Business Interruption

If a covered event such as a fire or natural disaster forces you to temporarily close your business. Additionally, business interruption insurance can help cover lost income and ongoing expenses until you’re able to reopen.

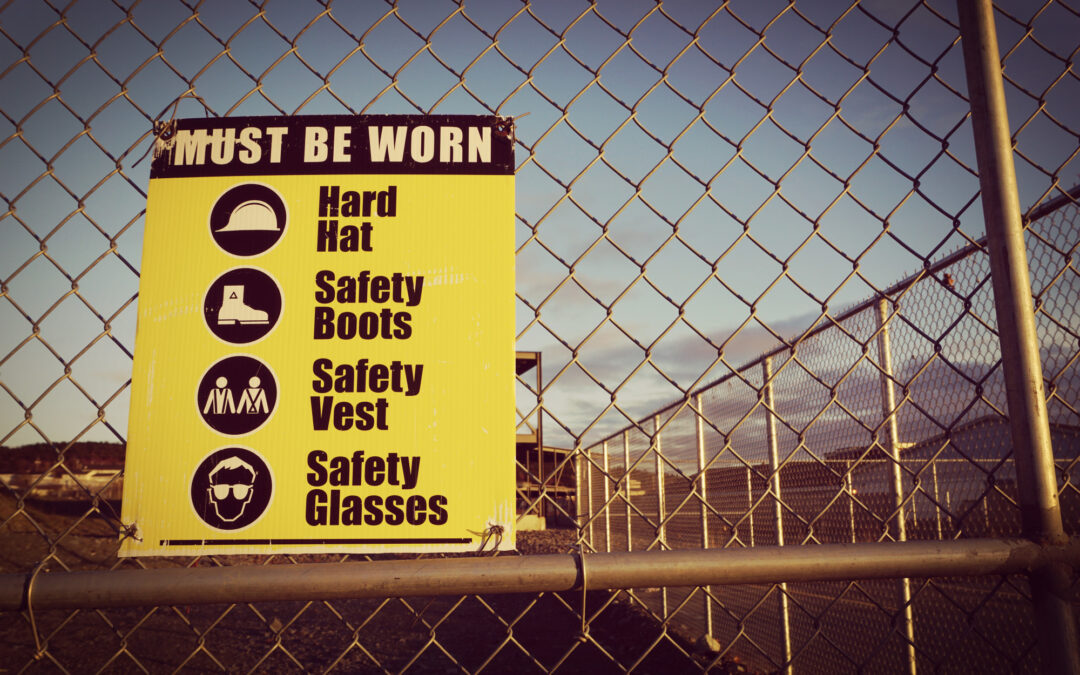

Workers' Compensation

In addition, accidents can happen in any workplace, and as a business owner, you’re responsible for ensuring the safety and well-being of your employees. Plus, worker’s comp insurance covers medical expenses, lost wages, and rehabilitation costs for injured employees.

Why Choose Advantage Insurance Solutions?

Local Expertise: With deep roots in the Denver community. Hence, we possess a nuanced understanding of the local business landscape and its challenges.

Tailored Solutions: We don’t believe in one-size-fits-all insurance. Instead, we take the time to understand your unique needs and tailor our solutions accordingly.

Responsive Service: Our dedicated agents are committed to providing prompt and attentive service, ensuring that your questions are answered and your concerns addressed on time.

Competitive Premiums: We offer competitive premiums that fit within your budget, allowing you to protect your business without overspending.

Streamlined Process: Additionally, from obtaining a quote to filing a claim. However, we’ve streamlined our processes to make insurance management as seamless. Plus, make it hassle-free as possible for our clients.

Unparalleled Customer Service: At Advantage Insurance Solutions, exceptional service isn’t just a promise—it’s our ethos. Therefore, we understand your business is your lifeline, so we’re dedicated to providing prompt, responsive assistance whenever needed. Plus, we’ve covered everything from clarifying policy details to processing claims efficiently.

What Our Clients Say

Hear what our satisfied clients have to say about their experience with Advantage Insurance Solutions

Great Company!! Easy to work with and efficient. I highly recommend working with Advantage!!

– Mark Krajewski –

AIS helps me, adult! I’ve been with Advantage Insurance Solutions for years and have always had a relationship with them. Tristen is smart and honest, she takes time to explain things in detail that I don’t understand. Despite, everything is expensive with inflation, they still found a way to save me money and keep full coverage and I added renters insurance this year. Thanks!

– Stephanie Reynolds –

Lori is amazing!! She’s been extremely helpful and saved us over $1000 a year on all our insurance needs. She is quick to answer questions and just all-around great to work with.

Thanks, Lori and staff.

– J Fehr –

I have used Advantage Insurance Solutions for years and appreciate that my insurance needs are always taken care of in a professional and friendly way.

– Nick Potter –

Advantage Insurance Solutions cut my monthly insurance bill by more than 50% with the same coverage! give them a try!

– Anthony Hoehler –

Advantage Insurance has helped me with many of my insurance needs. They are efficient and very professional. I’ve had policies with this company for the past 15 years at least. And I would recommend them to anyone with their insurance needs.

– Wanda –

At Advantage Insurance, we are your trusted provider of small business insurance in Denver, CO; we understand that every business is unique, so we take a personalized approach to insurance. Plus, our experienced agents work closely with you to assess your needs and craft a customized insurance package that aligns with your goals and objectives. Whether you’re a restaurateur, food truck owner, or rancher, we have the expertise and resources to design a policy that fits your business like a glove.

Lowering the Experience Modifier

What is an experience modifier? An experience modifier (EMR/Xmod) is a multiplier or a factor applied to the premium of an eligible policy. This provides an incentive for loss prevention. Workers' Compensation rating bureaus like the National Council on Compensation...

What Discount Should I Look For When Buying Auto and Homeowners Insurance?

What discount should we look for when buying auto and homeowners insurance? Having a house and a car to pay for needs a huge amount of money. And aside from paying for the mortgage, there are also fees for maintenance and of course insurance. Homeowners...

Homeowners Insurance Traps You Don’t Want To Fall Into

For many Americans, owning a home is an essential part of the American dream and one of the most important investments you can make. As your family grows, your needs for insurance will change as well as your risk. Reviewing your insurance program every year to make...

What Age Is Best For Getting Life Insurance?

Imagine this: you're young, fit, and healthy. You're busy building your career and your personal life. You don't need life insurance. Well, that may be how you feel now, but things can change quickly. This blog looks into what age is best for getting life insurance....

When Accidents Happen Part Two: If You Get Injured at Someone Else’s Property

Have you ever thought about what you would do if you get injured at someone else’s property? Nobody ever wishes for accidents to happen, and nobody enjoys wondering about what they would do if or when an accident does happen. However, it is for this very reason that...

Do I Need to Insure My Rental Property Differently?

When you are already insured with a Homeowners Insurance, it will be totally understandable if this question will pop into your mind. Because why do you need to have separate insurance to your rental place? What’s the difference? Landlord Insurance or Rental...

Coverage For Pet Dental Insurance And Other Diseases

You know that owning a pet means so much more than just having one more mouth to feed. You know that having a pet means having one more family member to love. One more family member to take care of and one more family member who definitely loves you back...

Starting A Restaurant Business in 2023

Restaurateurship 101: Start Your Own Business in 2022 Starting your own restaurant is easy. No, just kidding. It would take a lot of time and a lot of planning before you could even really get to Step 1, but it’s not impossible. Through this narrative, we will be...

Business Dental Insurance

Opening a Dental Clinic Opening a clinic to get into the dental practice comes along with the task of getting sued. Risks cannot be avoided completely, but you still have some options to limit or control them to your advantage. Someone who has just started with his...

How Much Should I Insure My House For?

Homeowners’ insurance is always a good choice to protect your investment. When you purchase your dream house, you will surely do anything to keep it and not go anything to waste. Even you pay a mortgage, homeowners’ insurance is always required for you to get a home...

Pros and Cons of Renting

Owning a house or renting a property? Find out which one works for you. There are many things to consider when deciding on buying a house or renting an apartment. Whether you are single and financially independent, a newly married couple, preparing to have...

Can I Get Pet Insurance After An Accident

If your pet gets into an accident without pet insurance, you can still get one, but note that the injury is now a pre-existing condition. It’s not the end of the world though. Read on to know what your option for pet insurance after accident is so that this doesn’t...

What Factors Impact the Cost of a Home Insurance Policy?

Most the first-time-home-buyers think that the cheaper the insurance, the better. Well, who doesn't want to save some money, right? But when it comes to insurance, cheaper is only sometimes better. Most industry experts say that homeowners' common mistake is...

Home Insurance vs Home Warranty: Buyers Guide

Advantage Insurance Solutions clarifies confusion between home insurance vs home warranty to better provide buyers a guide.

How AB 5 Has Affected California’s Gig Workers

California Assembly Bill 5 AB 5, short for California Assembly Bill 5 and also known as Gig Workers Bill, took effect on January 1, 2020. Others refer to AB 5 as Gig Economy Law. AB 5 was born following a landmark Supreme Court California case, Dynamex Operatons West,...

What Every Small Business Needs to Know About Workers’ Compensation

Employee safety Keeping employees healthy and safe is a top priority for small businesses. But accidents happen occasionally, and you don’t want to get embroiled in an expensive lawsuit over a workplace injury. For this reason, most states require employers to enroll...

Can I Get Pet Insurance Before Surgery?

Pet Insurance Before Surgery Getting pet insurance is usually one of the first things we do soon after we adopt a pet. However, life isn’t always perfect, and sometimes we forget. At times, circumstances just demand that we wait a bit. But what do you do when you find...

RV Insurance 101: What Does It Cover?

Before getting into what an RV insurance policy covers, let’s talk about what it doesn’t cover. It’s not the same as your typical auto insurance. It will have basic similarities in terms of coverage, after all, an RV is still an automobile. You may also have...

Is There Really A Life Insurance Gender Gap?

The simple answer is ‘yes’. However, a more relevant question remains - Why is there a life insurance gender gap to begin with? Sure, we’ve heard of a gender-based pay gap, which for a time was quite a hot topic, especially when Hollywood shone the spotlight with the...

7 Best Marketing Tips for Your Dental Practice — Keep Those Patients Coming

Just like any other business, you need to market or promote your dental practice to grow your customer base. You can’t just rely on your family and friends; and as much as word of mouth can be a very effective way to gain new customers, in today’s very competitive...

Top 3 Things You Should Ask Before Boarding Your Dog

There are more than 5,000 privately owned daycare in the country, and most of these daycares don’t have strict policies. That’s why choosing the right daycare to board your beloved pet is a must. Here are the top 3 things you should ask before boarding your dog: Ask...

Car VS RV Insurance, which costs more?

Insuring RV vs Car A traveling couple story Nelson and Sue are in their late 50s. They have been married for more than 30 years and are blessed with a son, Peter, and two Shih Tzus: Chubby and Chummy. We could say that “they have it made” and are living a comfortable...

How to Maintain Customer Loyalty: 7 Essential Practices

Finding out how to maintain customer loyalty in your business is the first big step you'll take for survival. Your existing customer base is what keeps you growing. Serving them, generating additional revenue, and benefitting from the word-of-mouth marketing they...

Preventing Sexual Harassment in the Workplace

In 2012, Ani Chopurian won a case on sexual harassment in the workplace against Mercy General Hospital in Sacramento, California. Ani allegedly filed numerous complaints in the two years she served as a physician assistant, and in those two years, nothing was done...

Top 5 injuries in Doggie Daycare Facilities and How to Prevent Them

Fur parents should be aware of how to prevent injuries when leaving their beloved pets at doggie daycare facilities. Love and Care People who own pets are no longer just simple animals. They brought these pets inside their homes and in turn, have become a unique...

A Dentist’s Guide On Dental Malpractice

When someone sees their dentist, even if it’s just for the first time, there is some basic amount of trust involved--that you, the licensed professional, has ‘earned’ the license to practice and that you will do everything in your capacity to ensure that the patient’s...

When Accidents Happen Part One: If Someone Was Injured at Your Property

Every now and then, we have people visiting our house for many different reasons. The most common would be family and friends visiting us. Have you thought about who else goes to your property? Let’s say— the pizza delivery guy, the cable guy, the cleaners, perhaps...

A Starter Guide to Owning a Commercial Building

A PROPERTY INVESTOR ONCE TOLD ME, DON’T LET YOUR FIRST PROPERTY BE YOUR HOME. LONG STORY SHORT, IT’S BETTER TO HAVE A PROPERTY THAT EARNS YOU MONEY. SO, WHETHER YOU ARE PLANNING ON BUYING YOUR FIRST PROPERTY OR PLANNING ON ADDING A COMMERCIAL BUILDING TO AN EXISTING...

Limited Liability Insurance: Separating Fact From Fiction

When you start a business, you're probably getting industry credentials, producing income, hiring staff, stabilizing cash flow, securing a strong market position in your industry, and growing the company. Insurance may be not be something you immediately think of. But...

7 Nifty Bits of Wisdom for Dental Practice Marketing

95% of small businesses plan on increasing their marketing budgets last year. With 2020 quickly approaching, it's time to reconsider your marketing plan again. Otherwise, your dental practice might not stand out from other practices in the area. This can cause you to...

Are You Ready for the Workers Comp Audit? 9 Tips You Should Know Now

As the owner of a business, you have a lot of different things to think about on a daily basis. You've gotten this far because of how much you care for your employees' safety; a concern that isn't lost on them. As such, you've selected a workers' comp policy that best...

Fleas At Work (Getting a Pet Care Facility Cleaned Up)

Fleas At Work Running a pet business means keeping a clean and pest-free workplace. One of the problems you won't ever want to happen in your workplace is the fleas that stay and multiply around the corners. Many pet parents wouldn't want to know that these pesky...

Do Dental Hygienists Need Dental Malpractice Insurance?

Dental hygienists have an awesome and challenging career. There may come a time that for some reason, there is a misdiagnosis or incorrectly done dental procedure that will turn any dental hygienist’s world around, and in turn, require Dental Malpractice Insurance. A...

How to Choose the Right Doggy Daycare for Your Beloved Pet

Our daily activities include how to take good care of our pets especially when we get to work during the day and go home in the afternoon, sometimes late at night. But how about our pets? Who will take care of them while we are away? With that said, choosing the right...

Advantages Of Pet Insurance: A Buyers Guide

A Guide To Pet Insurance Let’s admit it. Our pets are like our family. And some huge questions you need to take into consideration when we decide to get a pet such as what will we name them, what breed should we get and how much will it cost to care for them? Choosing...

Life Insurance: Is It Worth Getting One?

Contemplating Life and Insurance If you’re at a point in your life where you’re contemplating whether you should get life insurance, then you probably fall into one of these categories: You have people in your life who are financially dependent on you. You have people...

13 Very Important Safety Tips for Dog Groomers

For dog groomers, it is best to be mindful of your client’s dog and their safety. We came up with a guide for important dog grooming safety.

Our Pets Love Us

A Pet's Love We feel unconditional love for our pets, and our pets adore us! Our best pals are not fussy or selfish. Our pets love us unconditionally. Pets don't judge us when we're cranky or feel lousy. They'll never forget you as their best. Our pet adores us. They...

California Harassment Laws: Understanding Abuse and Harassment Laws in the State

When you run a business, it's particularly important that you get to know all about your potential liabilities and how you can address them. In this regard, civil cases are always a possibility. Harassment happens to be one of the most common forms of workplace...

Top 5 Things to Do Before Opening a Doggy Daycare Business

If you’re a dog lover, you understand how a doggy daycare can be such a lifesaver for busy pet owners. You know that a busy work life entails long hours away from home--which also means long hours away from your beloved pet. And it isn’t surprising that you’d want to...

Best Company To Get Renters Insurance

Top 9 Reasons to Get Renters’ Insurance It is common knowledge that homeowners’ insurance is one of the basic things a homeowner should secure as soon as they buy their first home. As the name implies, homeowners insurance offers protection for the property owner. It...

Life Insurance FAQs

What is Life Insurance? Life insurance is one of those things that people never seem to completely agree on. Coverage can come from many a Denver life insurance company or even from other US states. Why someone would need it? Why would it be a total waste of money...

The Joys and Pains of Owning a Pet Service Business

Starting a Pet Business One of the most thrilling thoughts a pet lover could have would probably be to own a pet service business. And if it were as simple as 1-2-3, perhaps 8 or 9 out of 10 pet owners would be considering this as the main source of their income. It...

What You Need to Know About Dental Malpractice and Tail Coverage

For many young and aspiring dental professionals in Denver, CO, or in any other state, not all are knowledgeable about dental malpractice and tail coverage or might need these in the future. An Ancient Medical Profession Dentistry is one of the oldest professions...

Becoming a Professional Dog Walker

We’ve all heard about how we should be doing what we love and how we should be pursuing our dreams. For many of us, the dream is to be able to work and earn as we would if we were at some multinational corporation. For others, it is leaving behind the comforts of...

Medical Malpractice Insurance: What Is It and Do Dentists Need it?

Best Malpractice Insurance for Dentists The total number of registered dentists in the US stood at 199,486 in 2018. This represents a ratio of 61 dentists per 100,000 Americans. Given this ratio, the demand for dentistry services may be overwhelming. ...

Learn How To Lower Your EMR Rating in 2023

How it all started In 1908 it was the federal government established a worker's compensation program for its civilian employees. It took a while for all 50 states to follow suit. But by 2015, thanks to both state and federal worker's compensation laws covered around...

What Is a Good EMR Rating? Understanding Your EMR Score

EMR Rating, EMR Score and Workers Compensation Insurance Did you know that most states require you to have a workers’ compensation insurance policy? It’s extremely important to have since work accidents can happen at any time. Are you wondering what your EMR rating or...

Moving to Colorado and Needing Homeowners Insurance?

Best Colorado Home Insurance Insurance can be comparable to searching for that proverbial needle in the haystack. It’s also similar to making that big step toward your move to Colorado. Both need your time to think through things, consider the pros and cons, and do a...

Water Loss Claim and Coverage Misconception

Water Loss at a Loss Did you know that water loss claims are the second-highest reported claim in Colorado after hail? Did you know that less than 25% of water losses are covered by your homeowner’s insurance? How can you know when to file a claim if you don’t know...