Introduction to Errors and Omissions Insurance

Denver, CO is a city that does not count on luck and hope to succeed, but ensures trust and reliability in every business. However, regardless of the level of professionalism, level of training, or sheer years of experience that you and your team possess underneath your belt, errors could be committed. It is actually not a matter of arguing with being able to do it itself; it is a mere realization of human tendency. That is where Errors and Omissions Insurance (E&O Insurance) steps in, helping a business to survive in the competitive market.

Imagine this: this recognising that due to the slightest of clerical errors, a little mistake by an employee, then a company has to pay so dearly, their clients’ reputations are at stake too. No matter whether you had a justification for it or not, the prospects of a legal action might be rather high. While your standard business liability insurance policy may provide coverage for any bodily injury, property damage, or advertising injury, what happens when an error or omission occurs that is not caught and results in harm to your company and its clients? To safeguard your business, you can walk into Advantage Insurance Solutions with your business issues with confidence and get covered by an Errors and Omissions Insurance policy.

Understanding Errors and Omissions Insurance

Errors and Omissions Insurance also referred to as Professional Indemnity Insurance is a liability insurance product that offers protection to business entities, employees, and professionals against legal actions arising from alleged acts of negligence or failure in performance. It normally contains both the fees of the court and any awards up to the amount of the insurance premium, making it one of the most effective financial safeguards for service providing companies.

Key Takeaways of Errors and Omissions Insurance:

- Comprehensive Coverage: Business and professionals can obtain E&O Insurance that protects them from claims of negligence as well as shoddy work from their customers.

- Essential for Service Providers: Not a single business entity that involves the provision of services for monetary remuneration such as medical practitioners, legal practitioners, certified public accountants, quantity surveyors, project managers, event planners, wedding planners, and so on should be without E&O Insurance.

- Broad Applicability: We now come to E & O Insurance that in its broad sense is indispensable to many professions comprising financial services and medical services among others, and which affords protection against different professional risks.

Why Denver Businesses Need Errors and Omissions Insurance

A demanding environment and numerous businesses make Denver’s economy one of the most diverse and promising yet risky for numerous sectors. Whether you are an IFPA member working on administrative levels dealing with unclear legislation or a wedding planner, a real estate agent who makes deals with valuable properties, the Errors and Omissions Insurance is your protection.

Protect Against Costly Lawsuits

Consider this scenario: This case involves a situation where a client takes legal action against a financial advisor after an investment turns out to be a bad one, even though the nature of such risks in the chosen investment option was clearly explained and fell within acceptable guidelines. While monitoring this particular aspect was outside of Markoff and Hopp’s technical expertise, even if the court were to rule in the advisor’s favor, the legal fees are staggering. About E&O Insurance, this is the insurance that will shield you from such financial loss hence making your business to remain active and your business integrity to remain strong.

Tailored Coverage for Specific Needs

E&O Insurance isn’t one-size-fits-all. At Advantage Insurance Solutions, we understand that each industry faces unique risks. That’s why our policies are customizable, ensuring you get the coverage that best fits your needs. Whether you’re a real estate agent, a printing company, or a consultant, our E&O Insurance provides robust protection tailored to your specific risks.

Advantages of Errors and Omissions Insurance

Comprehensive Protection: E&O Insurance covers a wide range of potential liabilities, from simple clerical errors to major oversights, providing peace of mind and financial security.

- Legal Cost Coverage: Legal fees can be a significant burden, even if you win a case. E&O Insurance covers court expenses and settlements, safeguarding your financial health.

- Industry-Specific Policies: Different industries have different risks. Our policies are tailored to meet the specific needs of various fields, ensuring comprehensive protection.

- Global Coverage: Many of our policies offer worldwide coverage, provided claims are filed in the U.S., its territories, or Canada.

- Coverage for All Employees: E&O Insurance typically covers business owners, salaried and hourly employees, and subcontractors working on behalf of the business.

- Past Work Coverage: Our policies can cover unforeseen claims arising from work completed before you were even insured, offering an added layer of protection.

Example of Errors and Omissions Insurance in Action

Imagine a server-hosting company in Denver suffering a data breach, exposing sensitive client information. The affected companies sue for damages due to inadequate security measures. With an E&O Insurance policy from Advantage Insurance Solutions, the server-hosting company can cover legal expenses and settlements, preventing financial ruin and maintaining client trust.

Why Choose Advantage Insurance Solutions for Your Errors and Omissions Insurance

At Advantage Insurance Solutions, we believe in more than just providing insurance; we believe in building lasting relationships with our clients. Here’s why we stand out:

- Personalized Service: We’re not just your insurance provider; we’re your neighbors. We understand the local business landscape in Denver and tailor our services to meet your specific needs.

- Expert Guidance: Our knowledgeable agents are dedicated to helping you forge the strongest shield possible. We carefully choose the insurance companies we represent to ensure they are both affordable and responsive.

- Flexible Payment Options: We offer monthly payment plans to help manage your cash flow effectively, making it easier to maintain the coverage you need.

- Responsive Claims Handling: In the event of a claim, time is of the essence. Our team is committed to providing swift and effective claims responsiveness to minimize disruption to your business.

- Tailored Coverage: We understand that no two businesses are alike. Our E&O policies are customized to address the specific risks of your industry, ensuring comprehensive protection.

- Comprehensive Solutions: From covering temporary staff and subcontractors to past work and worldwide claims, our policies are designed to provide all-encompassing protection.

Welcome to Advantage Insurance Solutions: We are here to cover your assets, which you have grown for years. Whether you are ready to talk about your Errors and Omissions Insurance policies with us or consider other types of insurance, we are always ready to assist with helping you.

Want to talk to us about collaborating or any other offers?

Send us an email at teamaismarketing@gmail.com.

Just getting the cheapest insurance is not enough since there are numerous factors involved. It is more about paying your premium a and getting a policy that will take care of you when you get half. At Advantage Insurance Solutions, we provide insurance solutions accompanied with a range of bundle services that will give our clients the best three attributes, namely; protection, reassurance, and choice. We are here to explain how Easy and Convenient Errors and Omissions Insurance works and to ensure your business’ protection.

For immediate assistance. Whenever you feel free to reach out to us via our toll-free number: 1 877 658 2472), at We offer you help and the service our clients require. Please give me the opportunity to fulfill that need and show you how Advantage Insurance Solutions can meet your needs.

Expert Grill Reviews for Summer BBQ in 2023

An Expert Barbecue for Summer 2023 Today we talk about some expert grill reviews. While there are states across North America that claim to be the leading state when it comes to barbecue. Kansas, North Carolina, Missouri, Texas, and even Kentucky claim the title of...

Spring Bounce Back in 2023!

As the weather starts to become warmer, the trees begin to grow, and the snow melts. We celebrate another spring. It is that time of the year when more people go out and some plan out home maintenance improvements from the winter season. And after winter, you should...

Thinking About Getting A Video Surveillance System or CCTV?

A picture is worth a thousand words. What is a video worth if such is the case? It is worth more than a million words, since, it can be worth one's safety and security. So, in this article, we will discuss audio-video surveillance systems. Audio-Video Surveillance...

How Doodly, A Whiteboard Animation, Can Help Your Agency Grow

Agency Growth with Doodly While visiting Facebook or other social media sites, you may notice interesting videos as you scroll through your feed. Some of these videos may show you sketches of different characters on the screen that look like someone was drawing or...

Carbon Monoxide Poisoning is a Toxic Silent Killer Gas

Every day, we are all at risk due to this colorless and odorless but toxic silent killer gas that is carbon monoxide. So, in today’s article, we help people understand and avoid carbon poisoning. What is Carbon Monoxide? Carbon Monoxide or “CO” is a colorless and...

Home Fireplace Safety and Home Insurance

Whether in Winter or just really cold months, heating bills can get higher than normal. If electricity consumption is too expensive, most people turn to wood as a source of heat. There are lots of equipment that you could use for heating, and the most commonly used...

10 Insurance Myths Debunked

Insurance has a lot of technicalities and rules. It can be overwhelming and confusing to first-timers and make your insurance journey slightly bumpy. Insurance is something that everyone needs, but since people tend to shrug off anything that they don't understand,...

The Benefits of Nationwide Travel Insurance

When planning a trip, the last thing you want to think about is what could go wrong. But the truth is, no matter how well you plan, there's always a chance that something could go wrong. That's where travel insurance comes in. Travel insurance is a type of insurance...

Where Should I Buy Gap Insurance?

What is Gap Insurance, and where should I buy it? According to research, your car’s value automatically decreases when it leaves the car lot. And by next year, it will lose more than 20% of its value. You need gap insurance. For example, you acquired a car for...

When Should I Stop Carrying Comprehensive and Collision Coverage On My Car?

Owning a car puts you in a position where you have no choice but to carry insurance. The good side is this is your safety net when unagreeable circumstances happen while you are on the road. Buying different types of insurance means you probably have combinations of...

I’m Driving My Own Car For My Business

There are some people who, in their daily grind, don't usually do the usual desk job. Specific business requirements involve mingling with clients, attending meetings and fundraisers, or company-hosted events. In these instances, it may be unavoidable for you to use...

Do I Still Need Workers Comp if I Only Have 1099 Contractors?

Workers’ Compensation Defined Workers’ Compensation is a type of insurance that protects employees from work-related injury or illness. It provides medical benefits, lost wage replacement, rehabilitation, and funeral expenses. Almost all U.S. states must purchase from...

The Best Time To Increase Your Deductible On Auto Insurance

We all want to save money. While insurance is essential, it should not weigh much on your financial status. There are so many combinations that are available on the market. Your insurance agent could guide you in finding the right one that suits your current financial...

Why Do You Need Wedding Insurance?

A wedding is one of the most memorable events that can happen in our lifetime. It is that one memorable day in our life that we will never forget for generations to come. More importantly, a wedding marks the start of one’s happily ever after. Behind any fairytale...

Denver Car Theft Rise in 2023

Car Thefts Rise in Denver The first quarter of 2021 saw a massive rise in Denver car thefts According to Colorado’s Metropolitan Auto Theft Task Force (C-MATT) in Jefferson County, there is an increase of 114% in car theft if we compare it to the same period last...

Sexual Harassment in the Workplace and EPLI Insurance

We have all heard about sexual harassment in the workplace. We see it on television and we hear about it in the news. But what does the possibility of a sexual harassment lawsuit mean for a company or a business? What are the implications when a supervisor or even a...

How To Promote Road Safety

Safe Driving Habits: How to Encourage and Promote Responsible Driving Driving your own car for the first time gives hype and excitement to explore the road. No wonder new drivers often encounter accidents. Even old drivers are not exempted from road accidents that...

Digital Tools To Super Boost Agency Growth

Digital Acceleration and Transformation Advantage Insurance Solutions has always been an old-school agency operating traditionally with pen and paper and face-to-face interactions. As an independent insurance agency in Denver, CO, this gave the company the chance to...

9 Useful Tools for Professional Groomers of Dogs and Cats

Grooming pets can be a hassle sometimes, especially for busy pet owners who have a lot on their plate to deal with. Whether it is for dogs or cats, Pet Groomers in Denver, Colorado, and everywhere else have the most effective tools to ensure that they give the best...

Top 9 Grocery Delivery Within An Hour: Alternatives to Instacart

Why I Chose Grocery Delivery Services I love cooking. And I really love cooking with fresh, healthy ingredients. The only thing I don't love? Grocery shopping. It's not that I hate the grocery store—it's just that there are so many other things I'd rather do on a...

9 Best Home Security Tips 2023

Best Home Security Tips The best home security tips can help you protect your house from robbers and thieves. Advantage Insurance Solutions provide instructions or how-to’s essential to landscaping, lighting, and other tips to help prevent theft. Spread the...

What Is The Purpose of Having an Independent Insurance Agent?

Enrico and Joseph Enrico is in the insurance industry working as an independent agent. His experience goes back at least twelve years when he was still an exclusive or captive agent. This is for one of the more prominent life insurance agencies. He has gained several...

A Brand New Business

A Brand New Business I have a new idea for a new show so let's forget about "Shameless," "Breaking Bad," or even "Game of Thrones." In addition, I don't know yet where the show will appear or who will even produce it, but I'm sure it will be a huge hit. Moreover, I...

Shipt Drivers in Colorado 2023

So, I finally did it! I decided to give Shipt a go a few months back. And, see if it lives up to the hype that my working mom and professional girlfriends were all claiming and raving about. And, oh dearie my! They were absolutely on point about Shipt drivers! I am...

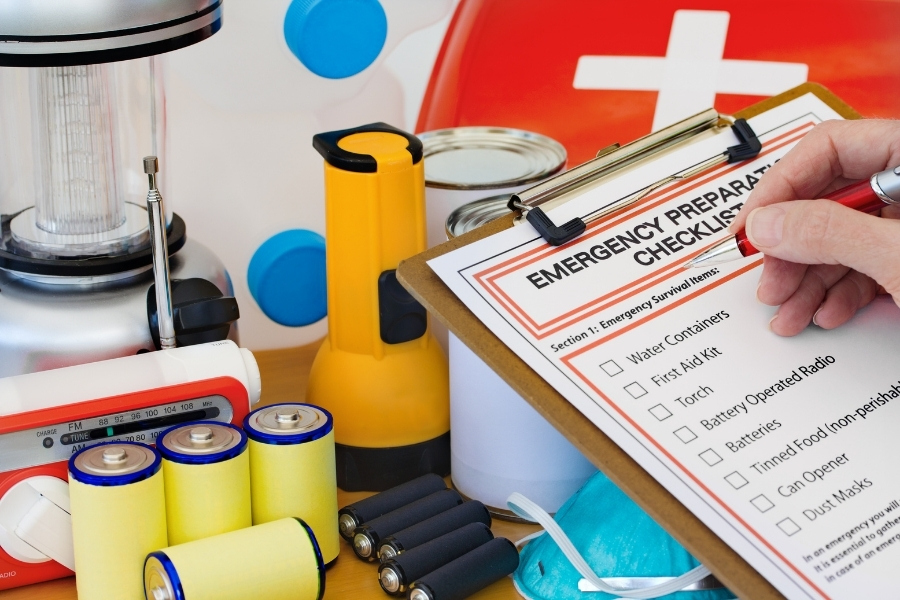

Basic Survival Equipment

No one is exempted when a disaster strikes, and the likelihood of one's survival could depend on how well-prepared one is in such scenarios. What kind of preparation does this entail? First, doing some research on what kind of disasters are likely to happen in your...

Smart Home Technology Products For Your Remodel

Smart Home Technologies for Your Remodel These are some of the most common reasons why people do whole renovations of their homes. Some homeowners start with the kitchen and bathroom first since these parts of your home need maintenance. Today we find out about new...

Lower Your Homeowners Insurance with Smart Home Technology

Do you know that new smart technologies and smart gadgets can help you lower your homeowner’s insurance premium? So today, we will discuss the benefits and risks of smart home technologies. To contact our insurance specialists, just click here and complete the form....

Top 9 Grocery Delivery Within An Hour: Alternatives to Instacart

Top 9 Grocery Delivery Services of 2022 Here are the top 9 grocery delivery within an hour and alternatives to Instacart. These are also going into 2021 and now 2022 which could help you get food at home. Now, the top grocery delivery service would bring fresh...

Safety Tips When Swimming In The Pool

Are you one of the lucky ones who have a pool in your own house? As summer comes, cooling off in a pool is one of the fun outdoor activities that you can enjoy with the whole family. However, as a homeowner or a parent, one of your responsibilities is to take...

Smart Alarm For Houses: What Is It And Do I Need It?

According to the Federal Bureau of Investigation, seven years ago, criminals committed 8.2 million property crimes in the United States. And 21% of these crimes are burglaries. Looking at these ratings, it is a no-brainer why people always think of home security...

Smart Home Technology and Cybercrime

Have Your Home Secured Home security systems might be one of the best investments you will ever make for your home. You protect your home at the same time you give yourself peace of mind. It deserves knowing that you can control it. And, monitor the security in your...

Have A Safe and Merry Christmas: A Christmas Tree Safety Tip

The holidays are fast approaching. Anywhere in the world, a sudden cold breeze will soon cover the land. It's time to pull out your winter coats, grab a pumpkin spice latte, and start thinking of how you will celebrate the holidays this year. Is everyone on your...

Home Generators: 10 Reasons Why You Should Get One

As we are all living in a world strongly dependent on gadgets and technology. This is why having a power interruption would not only interrupt our power supply but also disturb our day-to-day routine. It would branch out to different problems. Not just for you but the...

Safety Tips For Space Heaters

Safety Tips For Your Space Heater Heating has been a concept since the times of early mankind. Nobody knows when mankind was able to manufacture fire, but when they did, it was a means of comfort. But unlike the early man, we now also have to ensure safety when fire...

Gas Grill Fire

The grill has become a popular fixture at laid-back barbecues and neighborhood gatherings across the country. It’s already a custom here in the US. Grills, of course, still require regular maintenance even though it’s a convenient way to cook. It’s essential to be...

Disaster Recovery Planning Steps

Are You Prepared? As the word ‘Emergency’ means some kind of sudden, unforeseen, urgent that is needing immediate action or attention; this is definitely something everyone needs to be prepared for. We will discuss disaster recovery planning steps. We make it easy to...

Signs That Your Plumbing Has Problems

Unfixed plumbing problems can cause water damage in your home. It would take time and money to fix if this were left unfixed and ignored. Advantage Insurance Solutions discusses fixing plumbing problems. To contact our insurance specialists, just click here and...

Insurance Scams and How to Detect Them

Beware of these insurance scams! As per the latest FBI Reports, the insurance industry has more than seven thousand (7,000) companies that collect more than $1 Trillion each year. This incredible industry is, unfortunately as well the reason why insurance fraud is...

How to Insure my Home Properly: A Guide to Full Replacement Coverage

Underinsurance is one of the leading issues most American homeowners face. According to CoreLogic, a leading property data provider in the USA, Sixty-four percent of American homeowners are underinsured. Why is underinsurance a big deal for homeowners? Insufficient...

Pet Malpractice Insurance

Vets are still at risk of malpractice lawsuits. Although they only provide medical treatments to animals. More than 2,000 veterinarian malpractice cases are filed in the U.S. every year. In addition, practicing veterinary medicine comes with many risks as vets deal...

Comprehensive Guide to Commercial Property Insurance for 2023

Commercial Property Insurance Guide One of the best investments you can make is venturing into business. Putting up a business often requires vast capital. Moreover, business owners must invest in various assets like buildings and equipment. How can you do business...

Will Losses On My Workers’ Compensation Policy Impact My Premiums?

Workers’ compensation laws are quite complicated. Many business owners are at a loss on how workers comp rules and regulations work. A particular question insurance companies always get is, “Will losses on my workers’ compensation policy impact my premiums?”. Claims...

What is Private Client Insurance and How Do I Know if I Need It?

Who is a Private Client? Banks regard high-net-worth individuals as private clients. Moreover, these private clients are rich, wealthy individuals with significant financial portfolios. After, they often receive personalized services and products. Moreover, they also...

Does Your Business Need a Liquor Liability Policy?

People love to celebrate and have fun in bars and restaurants. In addition, alcohol brings life to parties, celebrations, and gatherings. But it can also cause fights and accidents. Also, did you know you’re liable for any alcohol-related incidents your customers may...

Car Insurance Trends in Colorado: Why Does It Feel Like My Rates Keep Increasing?

Every year, more and more car owners have noticed the trend of increasing car insurance rates in Colorado. There was an average $272 increase in car insurance premiums from 2015 to 2018. So, as with numerous car owners, you are probably wondering why your auto...